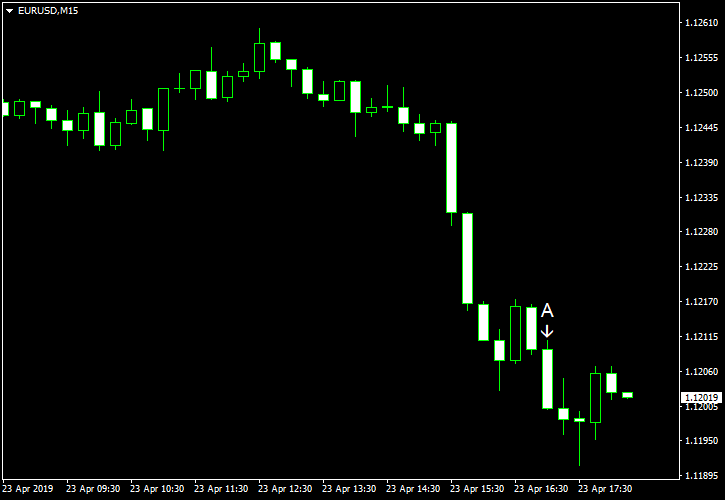

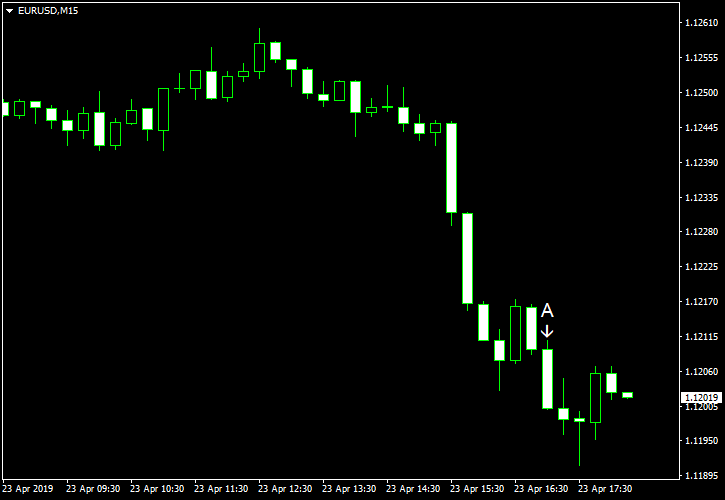

EUR/USD tumbled today despite there were no major events to explain the slump. Market analysts provided various possible reasons for the crash, including expectations of good earning reports for the first quarter from US companies and the divergence between monetary policy of the Federal Reserve and the European Central Bank. Whatever the reason, the currency pair erased gains of the previous two trading sessions and was trading at lows not seen since the beginning of the month.

Richmond Fed manufacturing index dropped from 10 in March to 3 in April, whereas analysts had expected it to stay unchanged. (Event A on the chart.)

New home sales were at the seasonally adjusted annual rate of 692k in March, up from the revised February level of 662k (667k before the revision) and exceeding the consensus forecast of 647k. (Event A on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.