The Great Britain pound versus the Australian dollar currency pair consolidates after exiting a pattern that points to the continuation of the upward movement.

Long-term perspective

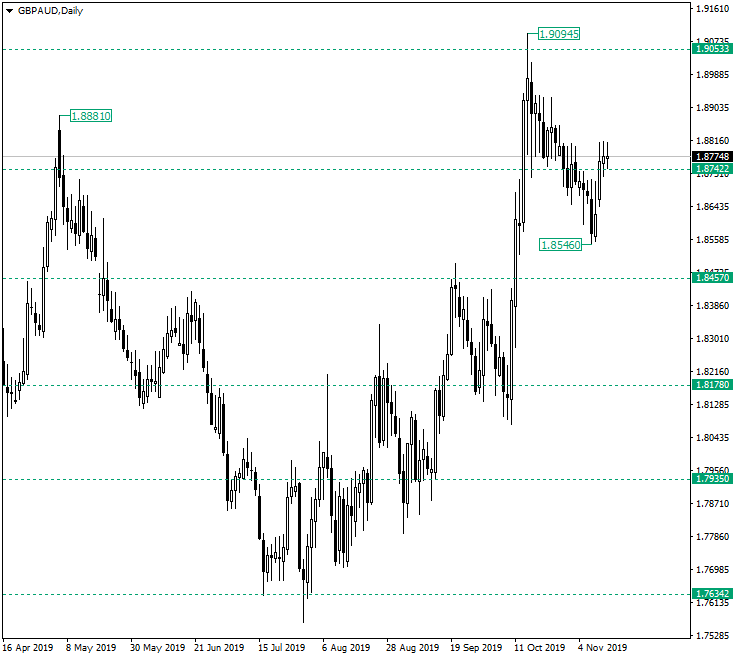

After confirming the 1.7634 support, the price entered in an ascending movement that conquered along the way important levels and then peaked at 1.9094.

After peaking, a correction began, one that ended by printing the low of 1.8546. From that low, the bulls began a rally that reconquered 1.8742.

The level of 1.8742 is an important one, assuming the role of resistance, as it can be seen from the peak of 1.8881 which is the result of a strong bearish pressure that manifested as the price tried to conquer the level.

The fact that this time the price was able to close two candles above it — November 11 and 12, respectively — is a sign that the bulls are gaining ground.

Of course, the bears will try to retake the level back. As a result, depreciation might be seen. Given the context, it represents a fresh opportunity for the bulls.

So, any crossing of the 1.8742 level, from above it to under it, may very well be a candidate for ending up as a false piercing of the 1.8742 support. This can be a bullish opportunity for both conservative and aggressive ones.

A conservative approach requires waiting for the price to get back above the level and thus to render the piercing as a false one.

The aggressive one will be attractive as long as the price is under the support, with the expectations of a quick appreciation to follow.

For both aggressive and conservative opportunities, the target is represented by 1.9053.

Only if 1.8742 ends up as being confirmed as resistance, then the price will target 1.8457.

Short-term perspective

The price was in an angled rectangle pattern that, because it points downwards and is preceded by an appreciation, should facilitate the unfolding of a new appreciation.

After exiting from the pattern, the price entered into a consolidative phase above 1.8732. The expectations are for an appreciation to begin after 1.8732 is reconfirmed as support of falsely pierced. This will trigger an upwards movement that targets 1.8896, followed by 1.9047.

Only if 1.8732 gets confirmed as resistance, then the price will revisit 1.8598.

Levels to keep an eye on:

D1: 1.8742 1.9053 1.8457

H4: 1.8732 1.8896 1.9047 1.8598

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.