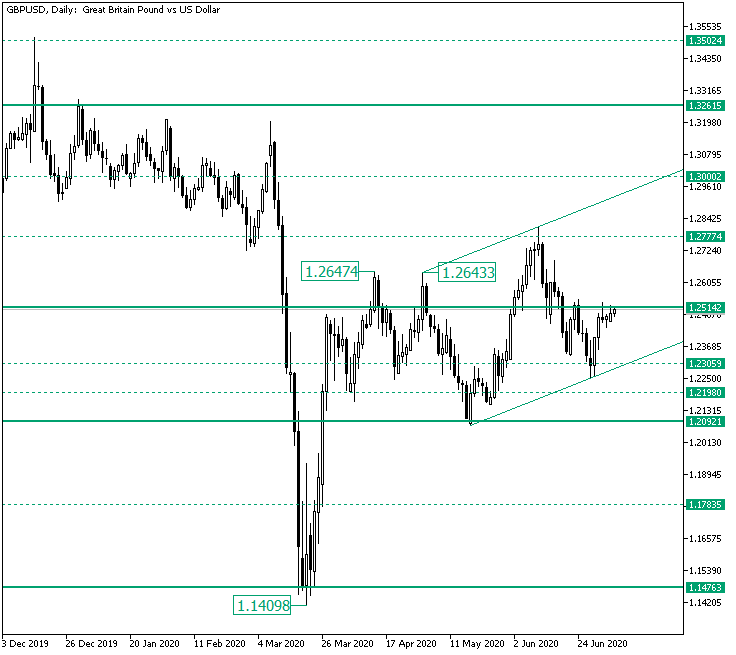

The Great Britain pound versus the United States dollar currency pair made a great recovery, but will the bulls be able to conquer 1.2514 as well?

Long-term perspective

The rally from the 1.1409 low, which confirmed the 1.1476 important support level, managed to pass the equally important 1.2092 area but was halted by 1.2514, both attempts of passing it failing and printing the 1.2647 and 1.2643 highs, respectively.

After retracing to 1.2092 and confirming it as support, the bulls got their necessary optimism to craft a new rally and pierce 1.2514, which they did on June 2. However, this victory got limited by the 1.2777 intermediary level and, later on, weight almost nothing as the bears pushed the price back under 1.2514, extending the bullish losses until the 1.2305 intermediary level.

But as the bulls did not give up, they tried yet another appreciation from 1.2305, bringing the price once more at the 1.2514 area. Considering that the price might already be in an ascending trend, a possible scenario is the one in which the bulls validate the 1.2514 level as support and then head on for the next area of importance, 1.2777, which also acts as their first target.

On the flip side, if 1.2514 proves to be strong resistance, turning the price around, then the bears might collect another series of profits by sending the price towards the double support defined by the lower line of the ascending channel and the 1.2305 intermediary level. Only a break under this area opens the door to 1.2092.

Short-term perspective

The descending trend that started after the formation of the peak of 1.2813 extended until the low of 1.2215. From here, after the confirmation as support of the firm 1.2282 level and the piercing of the double resistance defined by the upper line of the lower channel and the 1.2432 intermediary level, the price extended until the level of 1.2525, an intermediary level as well.

From here, the first scenario that may materialize si the one in which the price pierces 1.2525 and, with or without confirming it as support, heads for 1.2612, the first bullish objective.

The second scenario is for a consolidation phase to form, one bounded by 1.2525 and 1.2432. As long as it lasts, this sideways movement can facilitate the continuation of the surge that started from 1.2251, aiming for the same 1.2612.

Only if the price validates 1.2432 as resistance, then the bears could take the chance and try to carry the price towards 1.2282, their main objective for the time being.

Levels to keep an eye on:

D1: 1.2514 1.2777 1.2305 1.2092

H4: 1.2525 1.2612 1.2432 1.2282

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.