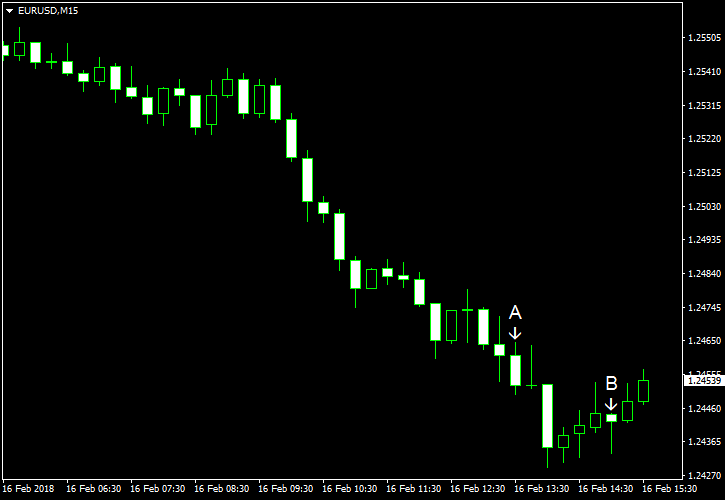

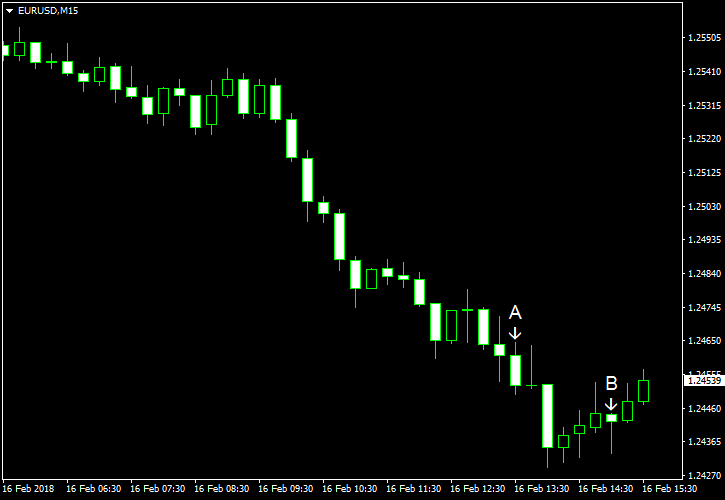

EUR/USD retreated from the highest level in three years. While positive US macroeconomic data released over the Friday’s session added to the downside momentum of the currency pair, most analysts believed that the reason for today’s decline was

Both housing starts and building permits rose in January. Housing starts were at the seasonally adjusted annual rate of 1.33 million, up from revised 1.21 million registered in December. Building permits were at 1.40 million, up from 1.30 million. The median forecast was at 1.23 million and 1.29 million respectively. (Event A on the chart.)

Import and exports prices were also up in January. Import prices increased by as much as 1.0%, accelerating from the revised 0.2% rate of growth logged in December and exceeding the analysts’ prediction of a 0.6% increase. Export prices edged up 0.8% following the 0.1% increase in the previous month. (Event A on the chart.)

Preliminary report about Michigan Sentiment Index showed an increase from 95.7 in January to 99.9 in February, touching the second highest level since 2004. That instead of falling to 95.4 as experts had predicted. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.