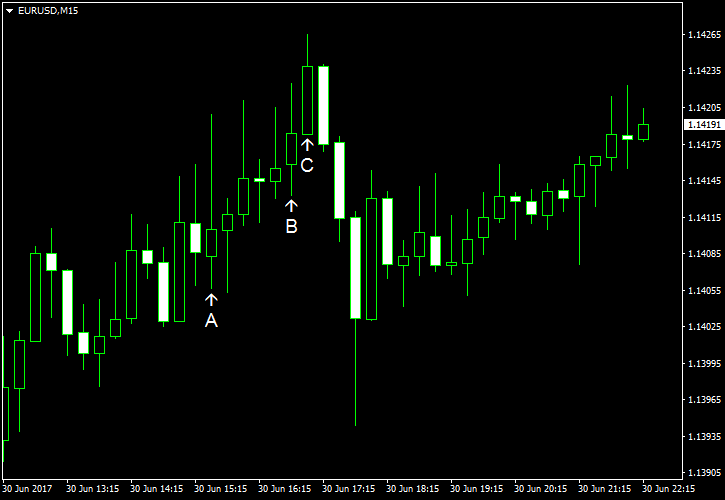

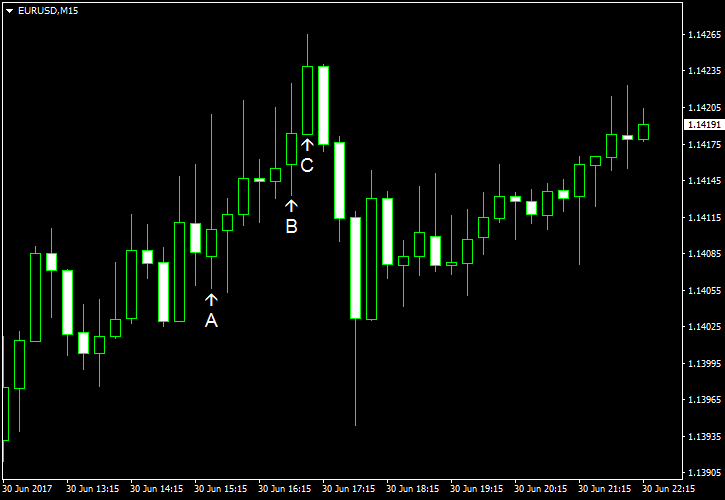

EUR/USD fell today even though economic indicators released in the eurozone were very good for the most part. US economic data was somewhat mixed, but not particularly bad either. Fundamentals remained in favor of the currency pair, and the current drop looks like nothing more than just a

Personal income and spending rose in May. Personal income was up 0.4%, while analysts predicted the same 0.3% rate of growth as in April (revised, it was at 0.4% before the revision). Personal spending edged up 0.1% last month, matching expectations, after rising 0.4% in the preceding month. Core PCE inflation was at 0.1%, the same as the forecast figure and the revised April reading (0.2% before the revision). (Event A on the chart.)

Chicago PMI climbed from 59.4 in May to 65.7 in June. It was a surprise to experts as they were counting on a decline to 58.1. (Event B on the chart.)

Michigan Sentiment Index fell from 97.1 in May to 95.1 in June according the revised estimate, slipping to the lowest level since Donald Trump was elected as US President. Forecasters predicted the index to be the same as the preliminary value of 94.5. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.