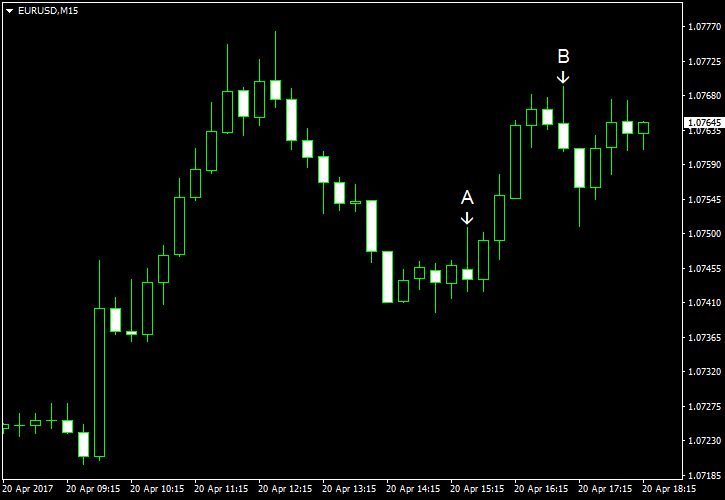

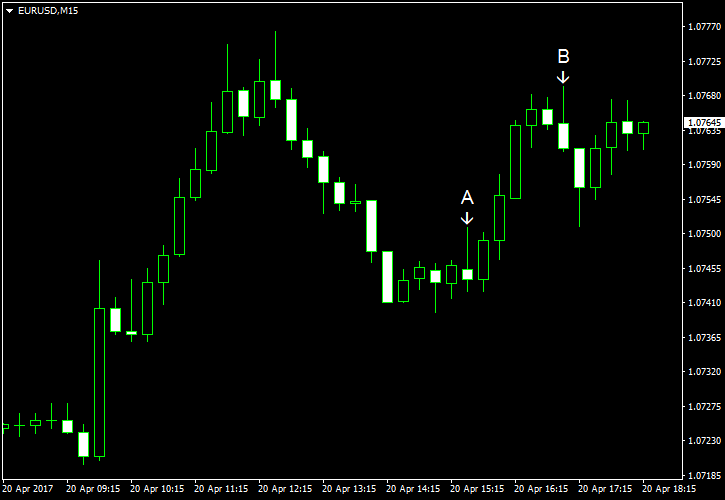

EUR/USD rose today, bouncing after yesterday’s small drop. One of the reasons for the rally was the improving consumer confidence, which now stands at the highest level since 2007. (Event B on the chart.) French election polls were also helping the currency pair, showing that

Philadelphia Fed manufacturing index slid from 32.8 in March to 22.0 in April, below the median forecast of 25.6. (Event A on the chart.)

Initial jobless claims rose from 234k to 244k last week. Analysts predicted a reading of 241k. (Event A on the chart.)

Leading indicators rose 0.4% in March compared to the forecast gain of 0.2%. The February increase was revised slightly to 0.5% down from 0.6%. (Event B on the chart.)

Yesterday, a report on US crude oil inventories was released, demonstrating a drop by 1.0 million barrels last week, exactly as analysts had predicted. Nevertheless, the stockpiles remained near the upper limit of the average range for this time of year. The reserves were down 2.2 million the week before. Total motor gasoline inventories increased by 1.5 million barrels last week and were also near the upper limit of the average range. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.