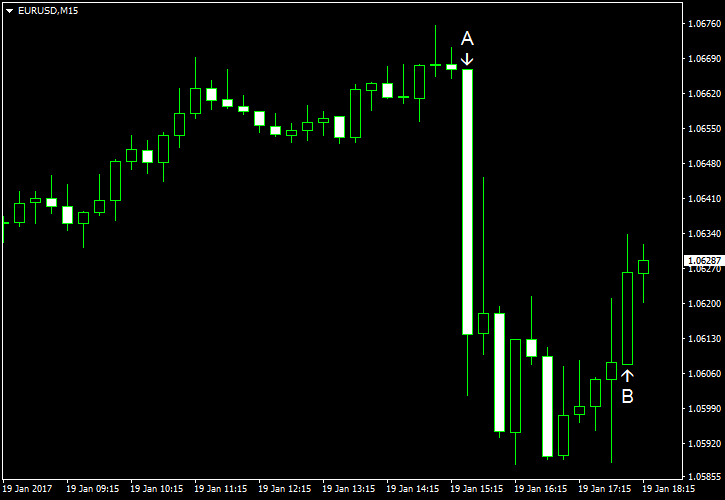

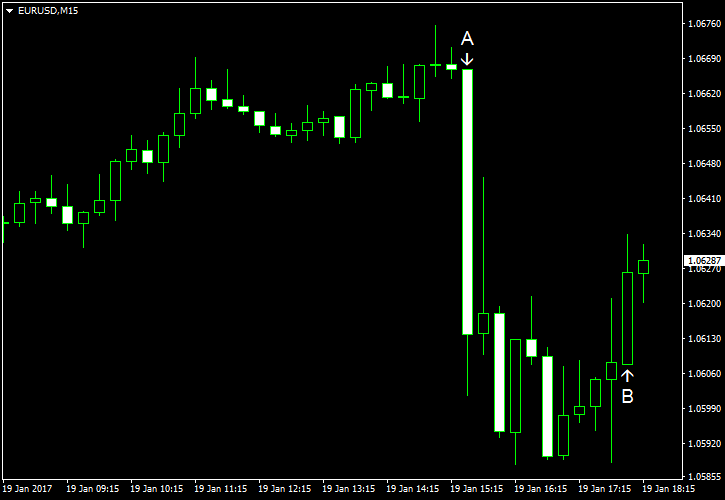

EUR/USD was trying to rally during the current trading session but slid below the opening level after the European Central Bank policy meeting. The ECB did not announce any change to its extremely loose policy, and ECB President Mario Draghi said that the central bank needs to keep stimulating measures in place and is ready to make policy even more accommodative in case of necessity. (Event A on the chart.)

As for economic data from the United States, it was better than expected for the most part, adding further pressure on the currency pair.

Housing starts were at the seasonally adjusted annual rate of 1.23 million in December, compared to the November level of 1.10 million and the forecast value of 1.19 million. Building permits were a the seasonally adjusted annual rate of 1.21 million, virtually unchanged from the previous month’s level and slightly below the reading of 1.22 million predicted by analysts. (Event A on the chart.)

Philadelphia Fed manufacturing index was up from the revised reading of 19.7 in December to 23.6 in January, whereas experts had predicted a drop to 16.3. (Event A on the chart.)

Initial jobless claims fell to 234k last week from 249k the week before (revised, 247k before the revision). (Event A on the chart.)

Crude oil inventories rose by 2.3 million barrels last week, far above the analysts’ median forecast of a just 0.1 million increase, and were near the upper limit of the average range. The stockpiles grew 4.1 million during the preceding week. Total motor gasoline inventories climbed as much as 6.0 million barrels and were above the upper limit of the average range. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.