- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Author: admin_mm

December 1

December 12020

Yen Weakest Despite Better-than-Expected Domestic Reports

The Japanese yen was the weakest major currency on the Forex market today, falling against all other most-traded rivals. Domestic macroeconomic data could not be the catalysts for the decline: it was not particularly good but not extremely terrible either. In fact, most of the reports beat expectations. The Statistics Bureau of Japan reported that the unemployment rate was at 3.1% in October — a nominal increase from September’s value of 3.0%. Markets […]

Read more December 1

December 12020

Swiss Franc Gains After Positive GDP & Manufacturing PMI Reports

The Swiss franc logged gains versus a basket of currencies today, getting help from positive domestic macroeconomic reports. Economists do not expect tomorrow’s data to be good, though. Switzerland’s Federal Statistical Office reported that gross domestic product grew by 7.2% in the third quarter of 2020 after falling 7.3% in the previous three months (revised positively from an 8.2% drop). Over the first half of the year, the economy contracted […]

Read more December 1

December 12020

Australian Dollar Mixed After RBA Meeting, China’s Manufacturing PMI

The Australian dollar did not show a clear trend today. The Reserve Bank of Australia left its monetary policy unchanged at its last policy meeting this year, as was widely expected. China’s macroeconomic data was helpful to the Australian currency. Surprising no one, the RBA left its monetary policy without change, keeping the key interest rate at 0.1%. The central bank noted that domestic economic indicators were […]

Read more December 1

December 12020

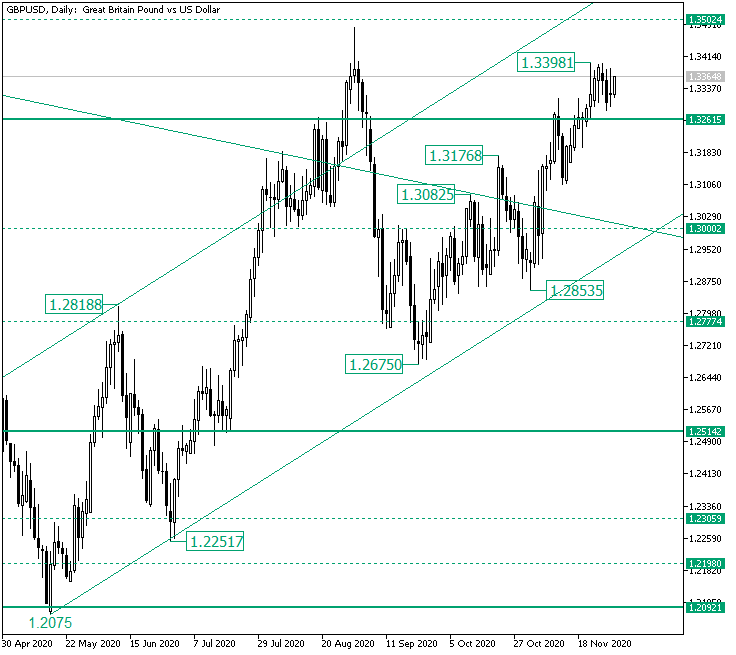

Consolidation Phase Above 1.3261 on GBP/USD?

The Great Britain pound versus the US dollar currency pair seems to have already started a consolidation. But is this really a consolidation, or are the bears preparing a new fall? Long-term perspective After the formation of the 1.2075 low, which validated the solid area of 1.2092 as support, the price started an ascending trend. The movement extended until very close to the 1.3502 intermediate level. From there, it printed a sharp retracement that, upon […]

Read more November 30

November 302020

Great Britain Pound Strong on Hopes for Brexit Deal

The Great Britain pound rose today, emerging as the strongest currency on the Forex market on Monday. The most likely reason for the sterling’s amazing performance was hopes for a trade deal between the United Kingdom and the European Union. The deadline of December 31 nears but there is no deal in sight. Just a few sticking points remained but the EU and the UK seem to have a hard time finding a compromise on them. Markets were hopeful, though, […]

Read more November 30

November 302020

Swiss Franc Soft Despite Better-than-Expected Data

The Swiss franc was soft for the most part today, though it managed to log small gains versus the Australian dollar and the Japanese yen. Better-than-expected domestic macroeconomic data was unable to bolster the Swissie. Switzerland’s Federal Statistical Office reported that retail sales adjusted for sales days and holidays rose by 3.1% in October from the same month of the previous year. That was a massive surprise to analysts, who were expecting just […]

Read more November 30

November 302020

USD/CNY Pauses Despite Another Surge in November Manufacturing

The Chinese yuan is trading flat against its US peer to kick off the trading week, despite the central government reporting renewed activity in the manufacturing sector this month. The yuan has been one of the top-performing currencies in the fallout of the coronavirus, surging to its best level against the greenback in more than two years. According to the National Bureau of Statistics (NBS), the manufacturing purchasing managers’ index (PMI) came in at 52.1 in November â […]

Read more November 30

November 302020

Australian Dollar Soft on Mixed Domestic Data, China’s Trade Conflicts

The Australian dollar was soft today, trading either flat or lower versus other most-traded currencies. Domestic macroeconomic data was mixed, giving no help to the currency. Better-than-expected economic releases in China were unable to provide a boost either. The Melbourne Institute Inflation Gauge showed an increase of 0.3% in November after falling by 0.1% in October. The Australian Bureau of Statistics reported that company gross operating profits rose by 3.2% in the September […]

Read more November 30

November 302020

NZ Dollar Flat-to-Higher After Domestic & Chinese Economic Reports

The New Zealand dollar traded largely flat today, though it managed to gain on some of the majors, including the US dollar. The kiwi got a boost from positive domestic macroeconomic data as well as better-than-expected reports in China. The ANZ business confidence improved from -15.7 in October to -6.9 in November according to the final estimate. The preliminary reading had promised the index to stay about unchanged. The report commented on the result: The New Zealand business sector […]

Read more November 30

November 302020

Japanese Yen Weak Despite Positive Domestic Reports

The Japanese yen was weak today even though domestic macroeconomic data released on Monday was good. There was no clear theme to drive markets at the start of the week. The week should be eventful, though, with plenty of economic releases basically every single day. Japan’s Ministry of Economy, Trade, and Industry reported that industrial production rose by 3.8% in October on a seasonally adjusted basis. While it was a small […]

Read more