- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

April 16

April 162008

Minor Fixing in MT4 Indicators

Due to some new code processing rules in the fresh versions of the MetaTrader 4 platform (I don’t know exactly from which build they’ve changed it) some of the indicators on my site stopped working right or just started to show errors in the platform’s log. Thanks to some conscious visitor, who notices the error and contacted me about it, I’ve corrected this issue with all three indicators that had such problem: Aroon Up & Down, Beginner, Float. I guess you’ll have to download […]

Read more April 16

April 162008

Bearish U.S. Fundamentals Help Euro Bulls

U.S. fundamental statistics, that were released today in abundance, appeared to be worse than the market analysts expected. It helped the EUR/USD currency pair to reach its new absolute maximum value at 1.5968 and kept dollar bearish also against the other major currencies. CPI (Consumer Price Index) rose 0.3% in March at the same pace as expected. In February this indicator was at 0%. Housing starts and […]

Read more April 15

April 152008

Dollar Grows Somewhat on Improved Manufacturing Outlook

The EUR/USD currency pair post some small drop today on Forex as the fundamental situation in U.S. economy looked better in April for the manufacturing sector. All of the reports that were released today in U.S. showed a positive dynamics for the dollar, helping it to go up against euro, pound and yen. EUR/USD is currently trading at 1.5784. Producer Price Index in March grew at an unexpected pace 1.1% […]

Read more April 14

April 142008

Dollar Gets a Blow after Good Start

After a weird 100 pips gap at todays Forex trading opening on EUR/USD pair, the U.S. dollar went sharply down. Its now forcing to stay at as little as 50 pips below the absolute maximum as the Forex traders fail to conclude a definite opinion on how to react on the fundamental statistics that came out today in U.S. Advance retail sales in March rose 0.2% compared to 0.1% forecast and 0.6% fall in February. Business […]

Read more April 13

April 132008

EUR/USD Trade Idea for the Next Week

The current situation on the EUR/USD daily chart seems like a good preparation for the long position. If you look at the picture below youll see three highs almost at the same level 1.5902 on March 17, 1.5896 on March 31 and 1.5913 on April 10. The corresponding lows of these highs conclude an uptrend. Altogether they form an ascending triangle, which is the known continuation pattern: Somewhere next week I expect the upper horizontal […]

Read more April 12

April 122008

Forex Technical Analysis for 04/14—04/18 Week

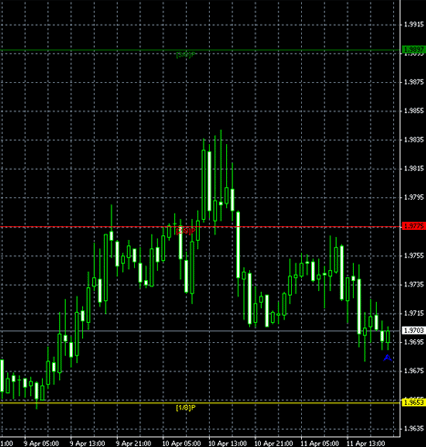

EUR/USD trend: buy. GBP/USD trend: sell. USD/JPY trend: sell. EUR/JPY trend: hold. Floor Pivot Points Pair 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res EUR/USD 1.5368 1.5498 1.5652 1.5782 1.5936 1.6066 1.6220 GBP/USD 1.9274 1.9462 1.9575 1.9763 1.9876 2.0064 2.0177 USD/JPY 96.91 98.46 99.74 101.29 102.57 104.12 105.40 EUR/JPY 155.48 […]

Read more April 12

April 122008

Bugfix and New Currency Pairs in Pip Value and Position Size Calculators

Ive fixed some javascript related bugs in both pip value and position size calculators. Those bugs prevented newer versions of non-IE browser from actually calculating any results. Ive also added new currencies and currency pairs to those calculators. Now they can handle 65 currency pairs. Here is the list of the currency pairs that were added today: AUD/DKK (Australian Dollar Danish Krone) AUD/PLN […]

Read more April 11

April 112008

MetaTrader Indicators Update

Two new MetaTrader indicators are now available for download from my site. Both indicators come from forex-tsd.com forums. They are very different, but they both looked quite interesting and useful to me. Murrey Math Line X indicates a set of support and resistance lines that can be used similarly to the common pivot points. It consists of 8 different lines, each representing a certain pivot […]

Read more April 10

April 102008

USD Rises on Better Fundamentals

EUR/USD reached a new record high level at 1.5913 today, but after some positive fundamental data was released in U.S. the currency pair went down, as the dollar started to regain strength on the Forex market. ECBs decision to hold the interest rates at 4% also improved dollars positions on the market. Initial jobless claims unexpectedly fell by 53k the last week from the revised 410k value to 357k. A fall to 383k has been expected by the market analysts. February […]

Read more April 9

April 92008

EarnForex Newsletter Announcement

Apart from some minor site redesign Ive added a new feature to the site today Forex newsletter. You can subscribe to it for free and receive monthly issues of the newsletter with a lot of interesting Forex information. The core of the newsletter is going to be composed of all the main Forex events for the month, some fundamental analysis and the news from the on-line Forex industry. […]

Read more