- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

July 12

July 122007

EUR/USD Uptrend Lowers Pace

EUR/USD, showing three days of straight growth with new monthly maximums every day, slightly lowered its rally today. Almost touching 1.3800 this currency pair stopped at 1.3797 and then rolled back for around 20 pips. Meanwhile, initial jobless claims for the previous week came out better than expected — 308,000 against 320,000 claims. U.S. trade balance came out at the expected level — $60.0 billions. […]

Read more July 11

July 112007

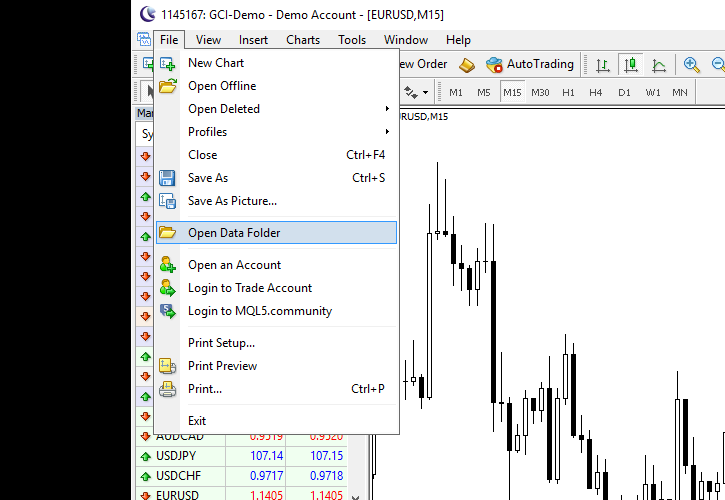

MetaTrader Expert Advisors — User’s Tutorial

Update 2016-05-09: The tutorial has been completely revamped to reflect the most current and easiest way to install new expert advisors in MetaTrader — both MT4 and MT5. Since MT4 Build 600, there is no difference in the way it is done in the two versions of the platform. Using MetaTrader expert advisors is simple, but sometimes people get confused about it. After downloading an expert advisor file, a user might […]

Read more July 10

July 102007

EUR/USD Renews Its Decade Maximum

Today EUR/USD hit 1.3738 mark renewing its maximum since 1995. So we are at the almost twelve years maximum now and the possibilities for going even farther are getting higher and higher. Not many reasons for such a strong Euro rally for today. The only good ones I can think of — oil prices rising and some Eurozone financial leaders speaking of support for an expensive Euro. Other than that — only […]

Read more July 8

July 82007

5 Things You Should Never Do in Forex

Revising my recent trades which were made during the last month I still find myself making the same mistakes I’ve been doing as a newbie trader. The amount of these mistakes lowered, but sometimes emotions overcome the mind and the strategy and as a result — pips are lost. Here is the list of most devastating and stupid things you can make in Forex trading: Don’t place stop-loss — sometimes I just forget to place, sometimes I hope […]

Read more July 7

July 72007

EUR/USD Technical Analysis for the 7/97/13 Week

General trend: bearish. Floor Pivot Points: 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.3419 1.3473 1.3550 1.3604 1.3681 1.3735 1.3812 Woodie’s Pivot Points: 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.3479 1.3561 1.3610 1.3692 1.3741 Camarilla Pivot Points: 4th Sup 3rd Sup 2nd Sup 1st Sup 1st […]

Read more July 6

July 62007

Employment Situation Data in U.S.

Some important macroeconomic data was released in U.S. today — employment situation in June from the Bureau of Labor Statistics. As it was expected by the financial analysts, the overall unemployment rate in June remained on 4.5% level — which is quite low and is a good indicator for the U.S. economy. Non-farm payrolls in June reached 132,000 which is 7,00 higher than the experts’ estimations. May non-farm payrolls were also revised towards […]

Read more July 5

July 52007

Good News from U.S. Economy

With an impressively high ISM Services index today’s macroeconomic data from United States was a very optimistic news for USD bulls. June ISM non-manufacturing index came out at 60.7% — 1% higher than May number, and a lot better than expected, since the negative change in ISM index was expected. Crude oil inventories for the previous week came out at a very good level too. They rose 3.1 […]

Read more July 5

July 52007

New Forex Book on Trading Psychology

Another free Forex e-book is now available for download from this site. It deals with trader’s personality and emotions which are inevitable in such an activity as a financial trading of any kind. Various examples and stories are presented in this book to help a trader to better understand what he must to prevent losing money and gain them instead: Your Personality and Successful Trading — by Windsor Advisory Services

Read more July 4

July 42007

Independence Day and Forex

Today EUR/USD was still as it was yesterday. As I said — this week will probably be flat until Friday at least (they tend to be quite unsettled, those Fridays). Independence Day in the United States of America is keeping the big U.S. Forex players out of the market, causing a lower volatility, especially on EUR/USD (while there some minor fluctuations on GBP/USD). It is quite clear that big holidays […]

Read more July 3

July 32007

EUR/USD Slight Correction

Today EUR/USD retreated from its yesterday levels of 1.3630 down to 1.3600 level (with a failed try ground below 1.3600). Factory orders macroeconomic data for May came out better than expected but it still showed a decrease in this important indicator — manufacturers orders decreased by 0.5% (against 1.2% expected). But this data didn’t affect Forex at all — the major bearish bars were seen four […]

Read more