- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

July 5

July 52017

EUR/USD Flat Despite Volatility Caused by FOMC Minutes

EUR/USD demonstrated volatility after the Federal Open Market Committee released minutes of its latest policy meeting. Yet despite the volatile moves, the currency pair was trading almost flat as of now. The notes showed that FOMC members were in favor of gradual reduction of monetary accommodation, but they gave no hints about timing of additional interest rate hikes. Factory orders fell 0.8% in May, more than in the previous […]

Read more July 3

July 32017

EUR/USD Declines After ISM Manufacturing PMI Climbs

EUR/USD climbed today as the dollar staged a broad-based recovery against its major peers. One of the reasons for the greenback’s rally was a surprisingly positive reading logged by ISM manufacturing PMI. Analysts are divided on whether the dollar’s rally was just a small upward correction in a bear market or it was something more significant. Final Markit manufacturing PMI fell from 52.7 in May to 52.0 in June. The actual reading was very […]

Read more June 30

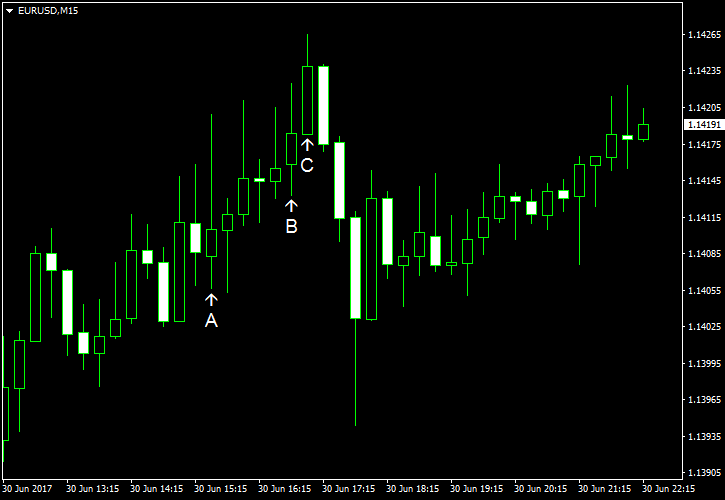

June 302017

EUR/USD Declines on Last Day of June

EUR/USD fell today even though economic indicators released in the eurozone were very good for the most part. US economic data was somewhat mixed, but not particularly bad either. Fundamentals remained in favor of the currency pair, and the current drop looks like nothing more than just a profit-taking after the impressive three-day rally. Personal income and spending rose in May. Personal income was up 0.4%, while analysts […]

Read more June 29

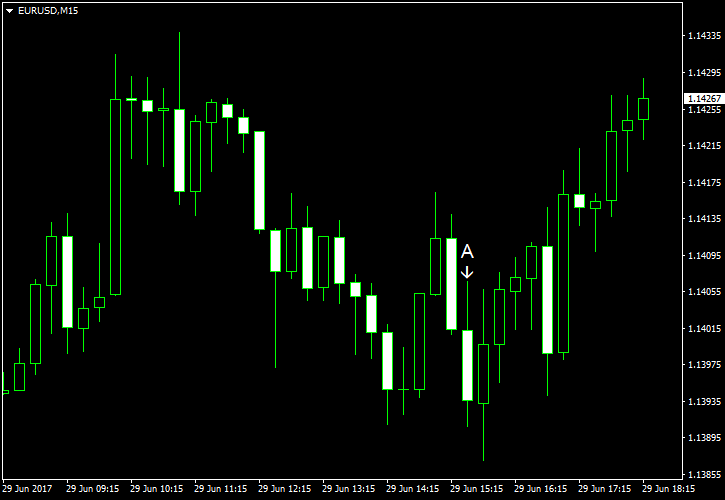

June 292017

EUR/USD Rallies Undeterred by Positive Revision to US GDP

EUR/USD gained today, rising for the third consecutive day, undeterred by the positive revision to the first quarter’s US gross domestic product. US GDP rose 1.4% in Q1 2017 while experts predicted the growth to be the same as in the preliminary reading — 1.2%. GDP increased 2.1% in Q4 2017. (Event A on the chart.) Initial jobless claims were at the seasonally adjusted rate of 244k last week. That is compared to the previous week’s revised level […]

Read more June 28

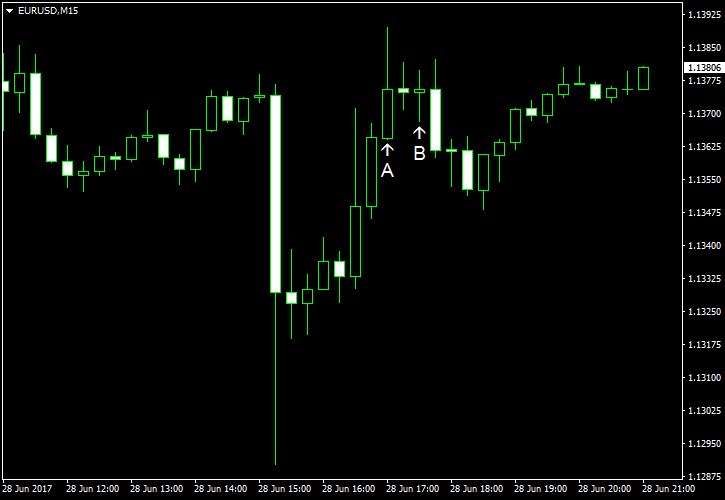

June 282017

EUR/USD Bounces After Dipping Intraday

EUR/USD slid intraday but bounced later after signals about possible monetary tightening in Great Britain and Canada drove the US dollar down. The unexpected drop of US pending home sales was not helping the greenback either. Pending home sales fell 0.8% in May from April instead of rising 0.9% as analysts had predicted. That was the third consecutive monthly decline. The April drop was revised from […]

Read more June 27

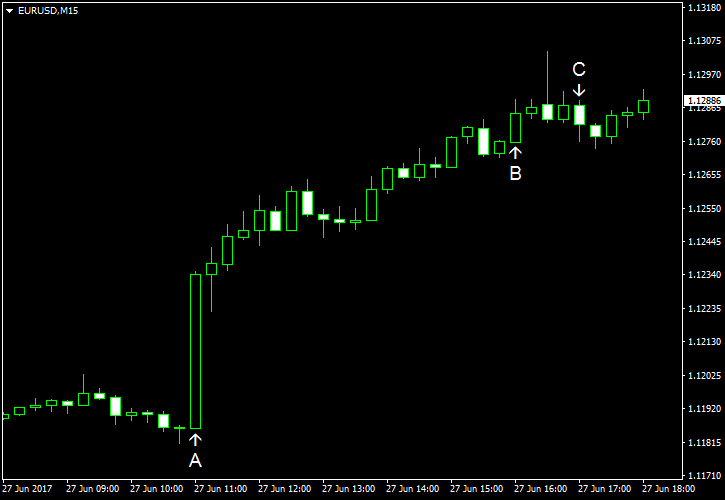

June 272017

EUR/USD Surges After Speech of ECB President

EUR/USD surged today after the speech of Mario Draghi, President of the European Central Bank. (Event A on the chart.) Markets considered his comments to be hawkish, that is why the currency pair reacted positively. Good US macroeconomic indicators halted the rally, but EUR/USD was still hanging near the day’s highs. S&P/Case-Shiller home price index rose 5.7% in April, year-on-year, while experts had predicted the same 5.9% increase […]

Read more June 23

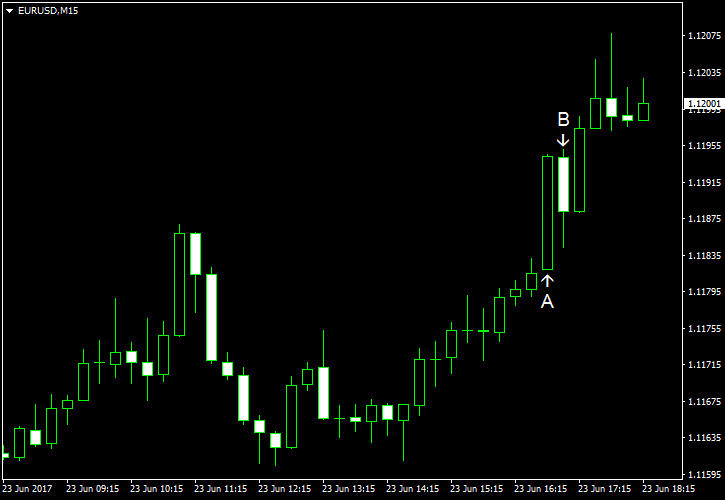

June 232017

EUR/USD Rallies After Markit PMIs Miss Expectations

EUR/USD rallied today after Markit released indicators for US manufacturing and services, which showed an unexpected drop. Better-than-expected housing data did not affect the currency pair much. Markit released a flash report for manufacturing and services in June, and both indicators missed expectations. Manufacturing PMI fell from 52.7 to 52.1, whereas experts predicted an increase to 53.1. Services PMI declined from 53.6 to 53.0 instead of rising to 53.9 as was […]

Read more June 22

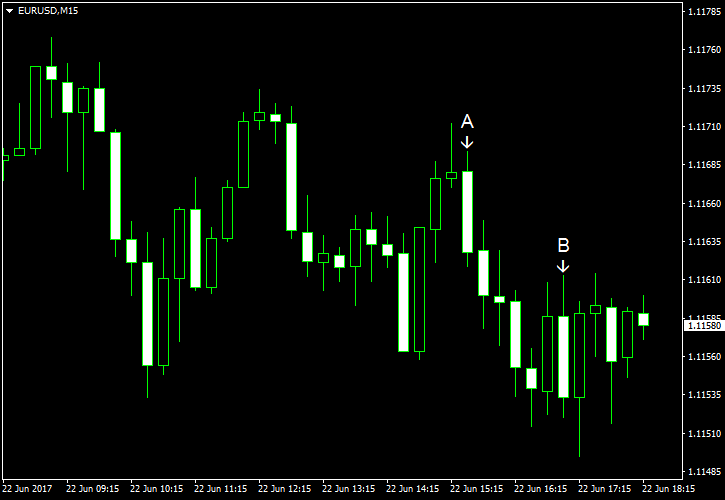

June 222017

EUR/USD Logs Marginal Loss Despite US Data

EUR/USD fell today despite disappointing macroeconomic data from the United States. The drop was marginal, though, and was not enough to erase yesterday’s gains, which were not big themselves. Initial jobless claims rose to 241k last week from the previous week’s revised level of 238k, exactly as analysts expected. (Event A on the chart.) 241k last week rose 0.3% in May — a bit less than was predicted (0.4%). […]

Read more June 21

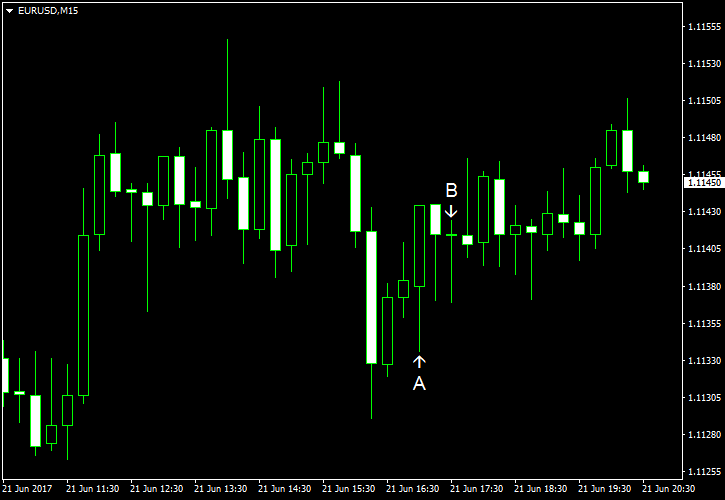

June 212017

EUR/USD Rallies Despite Positive US Housing Data

US housing data released today was very good, surprising market participants. It followed yesterday’s better-than-expected current account balance. Yet all the good reports did not prevent the dollar falling against the euro. The drop was marginal, though, and the EUR/USD currency pair was still trading lower on the week. Existing home sales rose to the seasonally adjusted annual rate of 5.62 million in May from the downwardly revised […]

Read more June 16

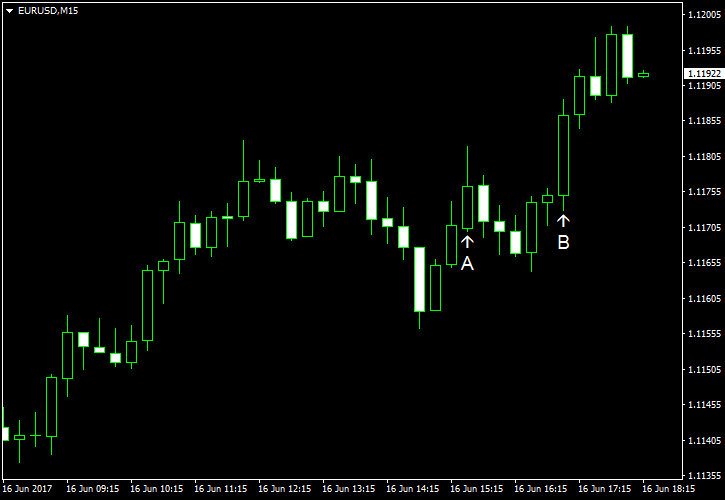

June 162017

EUR/USD Rallies on Back of Surprisingly Poor US Data

EUR/USD rallied today thanks to poor economic data released in the United States over the trading session. Housing data and the consumer sentiment missed forecasts, falling unexpectedly. That drove the dollar down against other rivals. Both housing starts and building permits fell in May instead of rising as experts had predicted. Housing starts were down to the seasonally adjusted annual rate of 1.09 million from the previous month’s revised value […]

Read more