- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

News

September 24

September 242020

Euro Falls Against US Dollar on Risk-Off Mood, Later Recovers

The euro today fell against the US dollar driven by the risk-off investor sentiment, which has been persistent this week triggering a selloff in riskier assets. The EUR/USD currency pair’s decline was also fueled by the weak German IFO survey data released earlier today combined with the greenback’s overall strength. The EUR/USD currency pair today fell from a high of 1.1679 during the Asian market to a low of 1.1626 in the early American […]

Read more September 24

September 242020

SNB Keeps Monetary Policy Unchanged, Swiss Franc Weak

The Swiss National Bank made a monetary policy announcement today but markets paid little attention to it. Currently, the Swiss franc is the weakest currency on the Forex market, even losing its earlier gains versus the Australian and New Zealand dollars, which themselves were very weak. It looks like traders continue to prefer the US dollar as a refuge, ignoring other safe currencies, like the franc and the Japanese yen. As was […]

Read more September 24

September 242020

US Dollar Finds Safe-Haven Support on Worse-Than-Expected Jobless Claims

The US dollar is finding support from investors who are seeking shelter following a worse-than-expected jobless claims report. The greenback has been climbing in recent weeks amid a return of volatility in the broader financial markets. With growing uncertainty in the economy surrounding the coronavirus and the upcoming cold and flu season, the buck might pare much of its losses by yearâs end. According to the Department of Labor, the number of Americans filing for first-time unemployment benefits […]

Read more September 24

September 242020

NZ Dollar Drops on Monetary Easing Outlook

The New Zealand dollar together with its Australian counterpart remained the weakest among most-traded currencies on the Forex market during today’s trading. The reason for such a poor performance was the outlook for monetary easing from the central banks of New Zealand and Australia. The Reserve Bank of New Zealand signaled yesterday that it continues to prepare for implementing negative interest rates and other measures to stimulate the struggling New Zealand economy, which got […]

Read more September 24

September 242020

Japanese Yen Remains Soft Despite Pessimistic Mood

The market sentiment remained pessimistic, encouraging investors to stick to safer assets. But that did not help the Japanese yen, which was one of the weakest currencies on the Forex market during Thursday’s trading. Today, the Bank of Japan released minutes of its July monetary policy meeting. The bank talked in the notes about recovery in the global economy: Overseas economies had been depressed significantly, reflecting the impact of the COVID-19 pandemic, although they […]

Read more September 24

September 242020

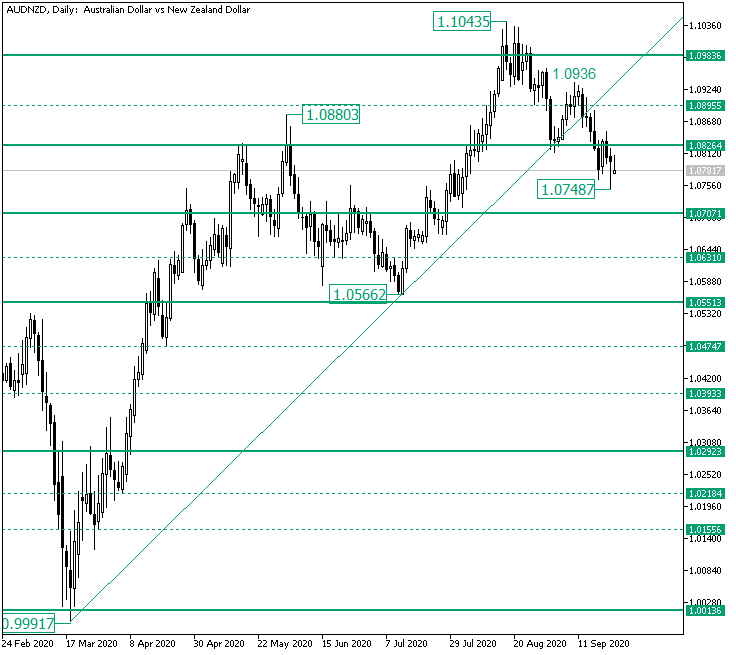

Bears Taking Control on AUD/NZD from 1.0856?

The Australian versus the New Zealand dollar currency pair slipped under the ascending trendline. Is this the end of the bullish dominance? Long-term perspective The rally that started from the 0.9991 low and which validated 1.0013 as support, extended, firstly, until the 1.0880 high. From there, a correction phase came into being, one that drew a retracement until the 1.0566 low. After validating the 1.0551 level as support and also etching the second […]

Read more September 23

September 232020

Japanese Yen Mixed amid Signs of Economic Slowdown

The Japanese yen was mixed today despite the relatively negative sentiment amid investors. Usually, the yen rallied amid risk aversion due to its status as a safe haven. But today, the currency was struggling to rise. Some analysts explained that by the rally of the stock market. Domestic economic indicators were not favorable to the currency of Japan either. European stocks rallied, with all major indices logging gains. That alleviated […]

Read more September 23

September 232020

US Dollar Among Strongest on Coronavirus Fears

The US dollar was firm today, battling with the Great Britain pound for the title of the strongest currency during Wednesday’s trading. Market analysts explained the strong performance by risk aversion on markets. Investors are worried about the impact of the coronavirus pandemic and measures to contain it. While many countries were easing restrictions, the surge of new cases around the world is likely to force governments to reinstall lockdown measures. Even without the second […]

Read more September 23

September 232020

Euro Rallies Against Dollar, Later Falls on Dovish Sentiment

The euro today extended its losing trend against the much stronger US dollar driven by the release of mostly negative euro area PMI prints by Markit Economics. The EUR/USD currency pair today fell driven by the massive demand for the greenback amid fears that the rising coronavirus cases would derail the global economy. The EUR/USD currency pair today hit a low of 1.1672 in the early Frankfurt session before rallying to a high of 1.1718, then […]

Read more September 23

September 232020

Australian Dollar Weak on Interest Rate Cut Outlook

The Australian dollar was one of the weakest currencies on the Forex market during Wednesday’s trading. The Aussie fell even against its New Zealand counterpart, which itself was extremely soft, though by now the AUD/USD pair has almost erased its losses. Market analysts thought that the main reason for the currency’s weakness was the outlook for an interest rate cut in the near future. Yesterday, Guy Debelle, Reserve Bank of Australia Deputy […]

Read more