- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

News

August 31

August 312020

Australian Dollar Among Strongest on Economic Data, Risk Appetite

The Australian dollar was among the strongest most-traded currencies today thanks to the risk appetite caused by the surge of the Nikkei stock index. Decent macroeconomic data in China, Australia’s biggest trading partner, and in Australia itself also provided support to the Aussie. The Reserve Bank of Australia reported that private sector credit fell by 0.1% in July, decelerating from the previous month’s 0.2% rate of decline and matching expectations. According to a report from the Australian Bureau […]

Read more August 31

August 312020

NZ Dollar Flat-to-Lower as Business Confidence Deteriorates

The New Zealand dollar traded either flat or lower against its most-traded peers today, though it managed to gain on few currencies, like the US dollar and the Japanese yen. The kiwi was soft despite the news about the lockdown easing in Auckland. The headline ANZ business confidence indicator was at -41.8% at the end of August, relatively little changed from the reading of -41.4% registered in the first half of the month. It was a significant drop […]

Read more August 31

August 312020

Japanese Yen Weakens on Disappointing Retail Sales, Construction Orders

The Japanese yen is weakening against multiple currency rivals to start the trading week, driven primarily by disappointing macroeconomic data. Despite higher-than-normal inflows into the traditional safe-haven asset, the yen slumped on worse-than-expected retail sales, construction orders, and housing starts. But could the worldâs third-largest economy get a boost from one billionaire hedge fund managerâs recent play? Retail sales tumbled 3.3% in July, down from the 13.1% […]

Read more August 31

August 312020

AUD/USD Above 0.7320. Could the Bulls Push the Price Further?

The Australian dollar versus the US dollar currency pair seems to have conquered 0.7320. Do the bears have any plans? Long-term perspective The rally that started at the 0.5700 low managed to fuel a very convincing upwards movement. Along the way, the rise validated important levels as support. However, because the last one, 0.7191, was not taken that much into consideration by the price action, the market participants could have argued […]

Read more August 28

August 282020

Euro Rallies Against the Dollar on Upbeat Euro Area Macro Prints

The euro today rallied higher against the US dollar capitalising on the greenback’s overall weakness since yesterday’s speech by the Fed Chair. The EUR/USD currency pair also benefitted from the upbeat macro releases from across the euro area, which lent support to the single currency today. The EUR/USD currency pair today rallied from a low of 1.1811 at the start of the Asian session to a high of 1.1919 in the mid-European market before giving up part of its […]

Read more August 28

August 282020

Japanese Yen Strengthens As Abe Resigns, Economic Activity Rebounds

The Japanese yen is strengthening against its currency rivals to finish the trading week. The yen has found support on Prime Minister Shinzo Abe stepping down and renewed economic activity in the worldâs third-largest economy. The yen has been performing well in 2020 as investors continue to seek traditional safe-haven assets in the fallout of COVID-19. On Friday, Japanâs prime minister announced that he would be resigning from his post as head […]

Read more August 28

August 282020

Franc Weak Despite Near-Record Jump of KOF Economic Barometer

The Swiss franc fell against almost all of the most-traded currencies today despite the near-record jump of the KOF Economic Barometer. The Swissie managed to gain only against the currencies that were weak themselves, like the US dollar, dragged down by yesterday’s speech of Federal Reserve Chairman Jerome Powell, and the Canadian dollar, which suffered from a sharp economic downturn in Canada. The KOF Business Barometer jumped from the revised July reading of 86.0 […]

Read more August 28

August 282020

Canadian Dollar Surges Against US Peer, Later falls on GDP Data

The Canadian dollar today surged against its US peer as the latter eas reeling from yesterday’s speech by the Fed Chair Jerome Powell, which unveiled a new inflation policy. The USD/CAD currency pair today fell for the fourth consecutive session to lows last seen in January as the greenback remained under intense selling pressure. The USD/CAD currency pair today fell from an opening high of 1.3132 during the Australian session to a low of 1.3047 […]

Read more August 28

August 282020

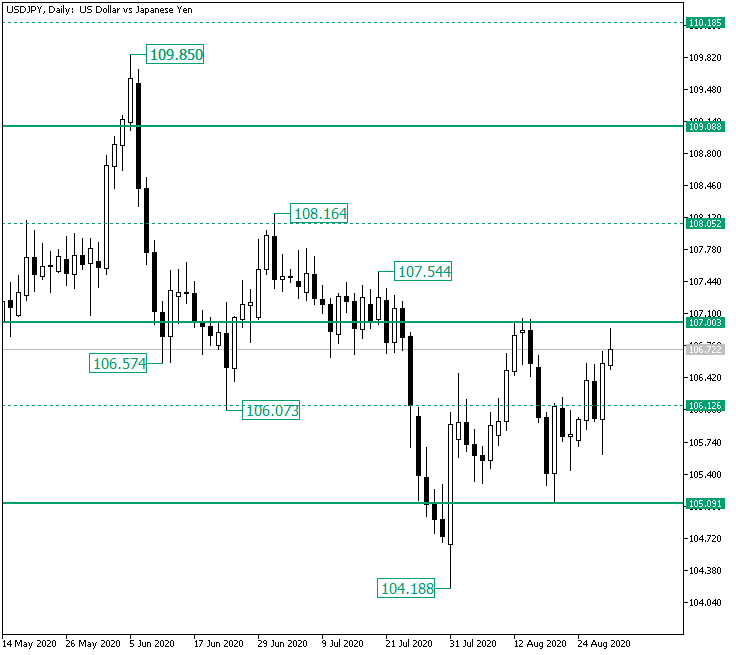

USD/JPY Confronting the 107.00 Resistance Level

The US dollar versus the Japanese yen currency pair seems to be willing to pass the 107.00 level. Will the bears defend it? Long-term perspective The fall from the 109.85 high extended until the 104.18 low. The high is part of a bullish overextension above the firm 109.00 level, while the low an overextension by the bears in relation to the major 105.09 level. The decline from the peak to the bottom passed yet another area of interest, the psychological level […]

Read more August 27

August 272020

Euro Swings Between Gains and Losses on Powellâs Speech

The euro today alternated between gains and losses against the US dollar swinging wildly between gains and losses ahead of Jerome Powell speech. The EUR/USD currency pair spiked higher and then crashed lower during the Fed Chair’s speech creating uncertain trading conditions for most traders. The EUR/USD currency pair today spiked to a high of 1.1901 during the Jackson Hole speech before crashing to a low of 1.1762 and was within the range at the time […]

Read more