- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

News

August 11

August 112020

US Dollar Struggles to Hold One-Week High on PPI, Falling Business Optimism

The US dollar is struggling to hold onto its best level in one week as higher producer prices and falling business optimism affected the greenback. After a near 7% slide in three months, the greenback has been holding steady so far this month amid uncertainty in the post-coronavirus global economy. But is the dollar oversold, or could inflation threaten its strength in international forex markets? In July, the producer price index […]

Read more August 10

August 102020

Euro Falls, Rallies, Then Falls Again While Trading Against the Dollar

The euro today fell against the US dollar driven by the risk-off investor sentiment, which fueled the greenback’s resurgence coupled with Friday’s upbeat US non-farm payrolls. The EUR/USD currency pair later found support and rallied higher amid improving sentiment as investors hoped for a resolution of the impasse on the US stimulus bill in Congress. The EUR/USD today fell from a high of 1.1801 to a low of 1.1740 before recouping most of its losses, then heading […]

Read more August 10

August 102020

Chinese Yuan Advances As PBoC Pledges Targeted Policy

The Chinese yuan is strengthening to kick off the trading week as the central bank vowed to adopt a more targeted and appropriate monetary policy in the post-coronavirus economy. With Beijing ostensibly winding down its ultra-aggressive stimulus and relief efforts on the monetary side, investors will be watching to see if Chinese investments will remain on an upward trajectory. The yuan is also testing 6.9 against the US dollar on the latest inflation data. Speaking […]

Read more August 10

August 102020

New Zealand Dollar Weaker During Monday’s Subdued Trading

The New Zealand dollar traded largely lower against its most-traded peers but, surprisingly, demonstrated resilience versus safer currencies, such as the Japanese yen and the Swiss franc. Macroeconomic reports in China, New Zealand’s biggest trading partner, were decent but data in New Zealand itself was not good. Trading was subdued today, especially during the Asian session, as markets in Japan and Singapore were closed for a holiday. ANZ […]

Read more August 7

August 72020

Canadian Dollar Weakens Against US Dollar on Upbeat NFP Data

The Canadian dollar today lost ground against its southern neighbour driven by the upbeat US nonfarm payrolls report for July released in the American session. The USD/CAD traded higher boosted by the risk-off investor sentiment in the face of rising US-China tensions but gave up some of its initial gains as the loonie clawed higher. The USD/CAD currency pair today rallied from an opening low of 1.3306 to a high of 1.3373 during the Asian session before […]

Read more August 7

August 72020

US Dollar Gains As Economy Reclaims 1.8 Million Jobs

The US dollar is strengthening against some of its most traded currency competitors to close out the trading week after the US government reported a better-than-expected jobs report. The economy continues to show signs that it is rebounding on the other side of the COVID-19 lockdown. But the labor market is still short 13 million positions that were lost amid the pandemic. According to the Bureau of Labor Statistics (BLS), the US economy […]

Read more August 7

August 72020

Euro Falls Against US Dollar Despite Upbeat Euro Area Macro Reports

The euro today fell against the US dollar as investors sold the single currency amid a risk-off market environment as Sino-US tensions skyrocketed on rhetoric from both countries. The EUR/USD currency pair fell despite the release of mostly positive data from across the euro area as investors flocked to the safe-haven greenback. The EUR/USD currency pair today fell from an opening high of 1.1881 to a low of 1.1810 in the mid-European session and was trading near these […]

Read more August 7

August 72020

Australian Dollar Soft amid Sino-US Tensions

The Australian dollar was one of the weakest currencies on the Forex market today, driven down by risk aversion caused by increasing geopolitical tensions between the United States and China. Domestic macro releases were decent but that did not provide the currency much help. US President Donald Trump wants to step up the tech war with China by banning TikTok and WeChat, apps owned by Chinese companies. Markets are cautious, […]

Read more August 7

August 72020

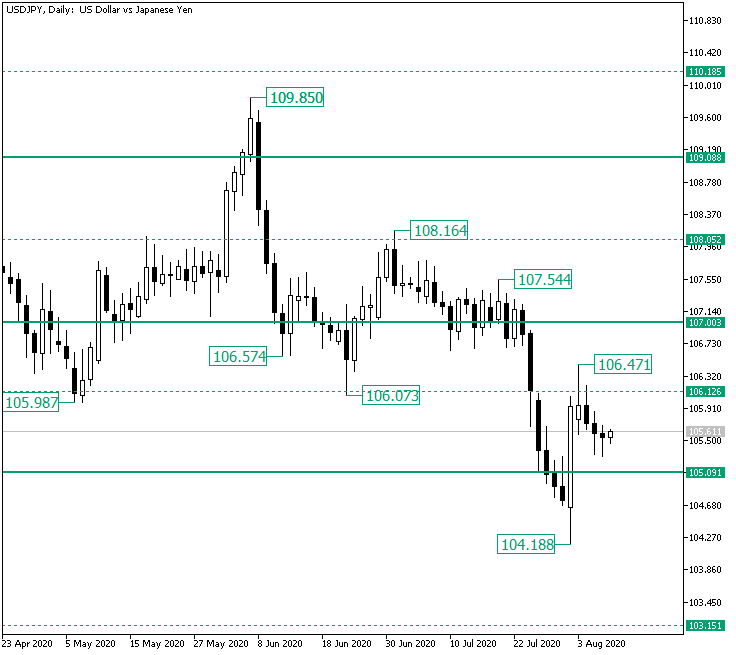

Will the 105.09 Support Hold on USD/JPY?

The United States dollar versus the Japanese yen currency pair seems to have lost its steam after a very strong appreciation. Was that all the bulls could do? Long-term perspective The fall from the 109.85 high, which is part of the false piercing of the firm 109.00 resistance level, managed to extend until the 106.12 intermediary level. The latter served as support, propelling the price back above 107.00, another steady level […]

Read more August 6

August 62020

Euro Fails to Hold On to New 2-Year Highs Hit Against the Dollar

The euro today traded lower against the US dollar after hitting new 2-year highs last seen in May 2018 earlier in the session to trade almost flat for the session. The EUR/USD currency pair broke above the crucial 1.1900 level but could not stay above the level and fell back as the bears took control of the price action. The EUR/USD currency pair today spiked to a high of 1.1915 before reversing and falling to a low of 1.1818 […]

Read more