- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

News

March 18

March 182020

Can AUD/JPY Fall More from 64.12?

The Australian dollar versus the Japanese yen currency pair continued declining. But the bulls might be just around the corner. Long-term perspective After confirming the support of 71.09, the price entered an appreciation phase that extended to as high as 76.54. After that, the price confirmed 76.02 as resistance, pierced 73.93 and confirmed it as resistance, and then continued declining, puncturing 71.09. After 71.09 was confirmed as resistance, the price further depreciated and then […]

Read more March 17

March 172020

Euro Falls to New Lows as Foreign Demand for US Dollars Skyrockets

The euro today fell against the much stronger US dollar amid a global rush for the world’s sole reserve currency as the world grapples with the coronavirus pandemic. The EUR/USD currency pair’s decline was further fueled by weak data from Germany and the euro area as European countries fight to contain rising coronavirus cases. The EUR/USD currency pair today fell from an initial high of 1.1189 to a low of 1.0955 in the American session and was trading […]

Read more March 17

March 172020

Japanese Yen Mixed on Tepid Data, Bearish Business Confidence

The Japanese yen is trading mixed on foreign exchange markets on Tuesday as recent economic data pointed to tepid conditions, diminishing overall business confidence. With the coronavirus crippling the worldâs third-largest economy, policymakers are discussing a lot of ways to spur growth, including targeting the national sales tax. According to the Cabinet Office, machinery orders rose 2.6% in January, up from the 11.9% decline in December. Analysts had projected a decrease of 1.6%. […]

Read more March 17

March 172020

AUD Extends Drop After RBA Policy Minutes, Poor Economic Data

The Australian dollar attempted to rally today after the release of monetary policy minutes from the Australian central bank and domestic macroeconomic data but failed and continued its crash to new multi-year lows. The outlook for another interest rate cut was not helping the Aussie either. The Reserve Bank of Australia released minutes of its March 3 monetary policy minutes, at which Australian policymakers decided to cut the main interest rate by 25 […]

Read more March 17

March 172020

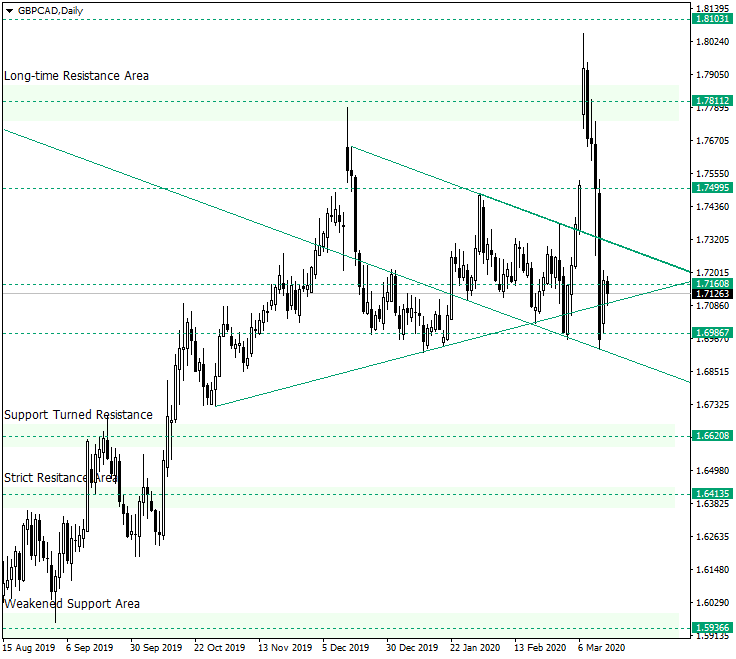

Support of 1.6986 Still Holds on GBP/CAD

The Great Britain pound versus the Canadian dollar currency pair respects some very important lines. But which are the new perspectives concerning the old lines? Long-term perspective The ascending movement that started after the major support area of 1.5336 was confirmed extended almost to the 1.8103 level, retracing shortly after, thus rendering the piercing of the long-time resistance area of 1.7811 as a false one. The retracement became a plunge that pierced […]

Read more March 16

March 162020

Canadian Dollar Crashes As Trudeau Shuts Down Border Over COVID-19

The Canadian dollar is crashing against most currency rivals on Monday after the federal government announced that it would shut down the border to non-Canadian citizens. Anyone who is showing symptoms of Covid-19 will not be permitted to enter the country. This was Prime Minister Justin Trudeauâs first major policy response to the virus outbreak, and he confirmed that more fiscal announcements will be coming this […]

Read more March 16

March 162020

Chinese Yuan Slumps As Industrial Output, Retail Sales Crash in COVID-19 Fallout

The Chinese yuan is slumping against multiple currencies to kick off the trading week, driven by a crash in key economic metrics. With a myriad of January-to-February reports coming in, global financial markets are gaining insight into just how much the coronavirus damaged the worldâs second-largest economy. Despite Beijing in the beginning stages of rebooting its economy, it is unclear how long it will take for China to return to full […]

Read more March 16

March 162020

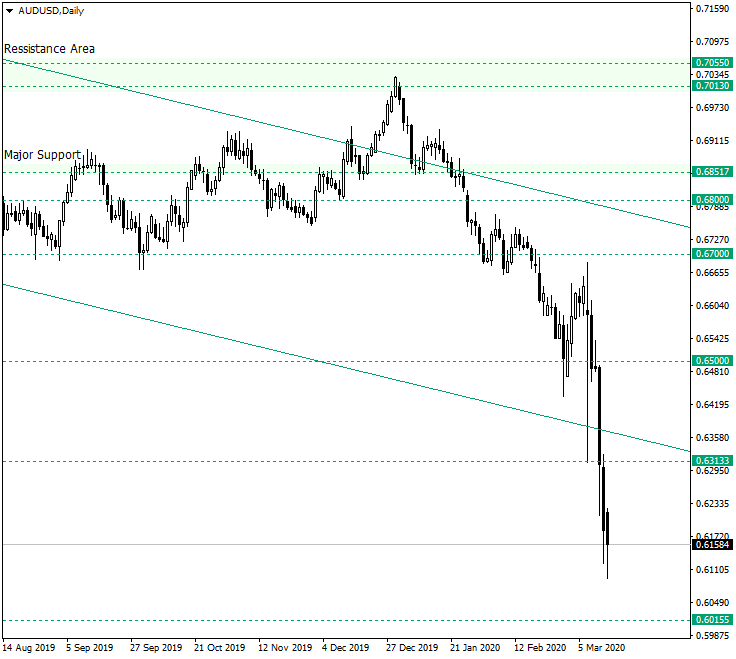

Can 0.6000 Stop the Decline on AUD/USD?

The Australian dollar versus the US dollar currency dropped sharply, but there are some chances for the bulls. Long-term perspective The depreciation that started after the resistance area of 0.7055 and 0.7013, respectively, was confirmed caused a retracement from the 0.6500 mark. The retracement almost touched the 0.6700 level after a decline that reached the 0.6313 level. However, what followed was a strong depreciation, one that managed to pierce 0.6313. One […]

Read more March 16

March 162020

NZ Dollar Tumbles After Emergency Interest Rate Cut from RBNZ

The US Federal Reserve was not the only central bank to make a surprise interest rate cut at the start of the week. The Reserve Bank of New Zealand also announced an emergency cut overnight. Unsurprisingly, the New Zealand dollar reacted negatively to the announcement, opening sharply lower at the start of trading. While the kiwi has trimmed losses by now, it is still trading below the opening level against other currencies, even the US dollar. […]

Read more March 16

March 162020

US Dollar Opens Sharply Lower After Another Surprise Cut from Fed

The US dollar started Monday’s trading session sharply lower compared with Friday’s close. The reason for that was another surprise interest rate cut from the Federal Reserve. Currently, the greenback tries to recover but still trades below the previous session’s close against most of its major rivals. The Fed in a surprise move announced a cut of the target range for the federal funds rate by a whole percentage point to 0%-0.25%. As one could […]

Read more