- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

January 10

January 102008

Pound Down, Euro Up after Central Banks’ Decisions

Both central banks decided their monetary policy changes today regarding their main interest rates. Both Bank of England and European Central Bank left their interest rates unchanged — 5.50% and 4.00% respectively as the majority of the market experts were predicting. As the decisions were expected, they didn’t gave the speculators any surprise to trade on, but the GBP/USD went volatile immediately after the report went public, first gaining […]

Read more January 10

January 102008

Foreign Currency Reserves Up in Japan

Japanese Ministry of Finance released a report today regarding the country’s international exchange reserves and the foreign currency liquidity along with the structure of the overall assets as on the end of December 2007. The value of the total foreign exchange reserves accommodated by the Japan reached $973.36 billion — breaking the record high level again after gaining about $3.18 billion compared with the value at the end of November. The boost in the foreign currency reserves is attributed to the elevated demand […]

Read more January 10

January 102008

Interest Rate Decision’s Influence on EUR/USD

Today the European Central Bank decided to leave the interest rate unchanged at 4.00%, as it was expected by the markets. But the EUR/USD went up after the decision became known — the currency pair gained more than 70 pips. What has caused that? Along with the rate decision ECB announced another $20 billion intervention to the banks to add more dollar liquidity. That greatly cut the dollar’s position on Forex, especially […]

Read more January 9

January 92008

Japanese Yen Down Today

Tokyo based massive sale of the Japanese yen spurred the daily drawdown of this Asian currency. Residents preferred to sell the yen opting for the riskier but higher yielding currencies, such as euro, Australian and New Zealand dollar and South african rand (so called carry trade investing). The investors’ confidence for the global financial system’s stability was greatly inspired with the recent advances on the Japanese stock markets following the announcement by the U.S. government […]

Read more January 8

January 82008

Rupee Rises on Capital Inflow

The Indian rupee rose today again, making a fourth bullish day in a row after the national stock index rally attracted the investments of the global funds to into the Indian emerging economy. The rupee was traded at the highest rate against the U.S. dollar in almost ten years. The major catalyst for the rupee’s […]

Read more January 8

January 82008

Random Forex Trading Expert Advisor

Recently I was reading about the random walk hypothesis and I’ve got interested in this idea. So, I though that it would be really fun to develop a MetaTrader expert advisor that will trade completely random. No indicators or other ways to base the forecasts on the past data, just a plain “coin flipping”. After several days of coding and testing (testing mostly) the myRandom expert advisor was ready. It enters […]

Read more January 7

January 72008

Canadian Dollar Doomed to Lose in 2008?

The Canadian dollar showed an unprecedented growth against the U.S. dollar last year. Rallying almost straight from 1.1635 to 0.9905, USD/CAD lost almost 15% in one year and broke two important support levels — psychological barrier of 1 CAD per USD and reaching its lowest value since the floating of the USD/CAD rate — 0.9057. The growth of the Canadian dollar was mainly caused by the more than 50% rally of the oil prices and similar […]

Read more January 7

January 72008

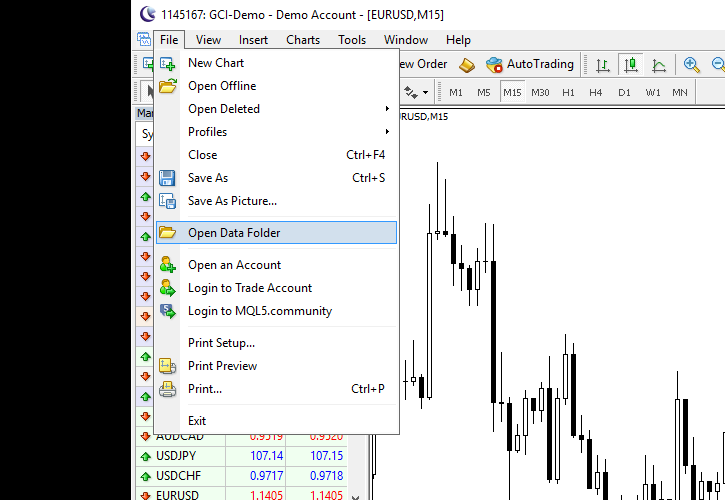

MetaTrader Indicators — User’s Tutorial

Update 2016-05-09: The tutorial has been completely revamped to reflect the most current and easiest way to install new indicators in MetaTrader — both MT4 and MT5. This tutorial covers indicator installation for MetaTrader 4 and 5. Since MT4 Build 600, there is no difference in the way it is done in the two versions of the platform. There are many free MetaTrader indicators available online, but some people still encounter […]

Read more January 6

January 62008

Carnival of Forex Trading — January 6, 2008

Welcome to the January 6, 2008 edition of Carnival of Forex Trading. Ian Welsh presents Has the Dollar Hegemony’s Tipping Point Been Passed? posted at The Agonist, saying, “Being the standard reserve currency mattered. Knowing when the switch is occuring will be important for betting the trend.” Vahid Chaychi presents Is Forex a Suitable Job for Everybody? posted at Weboma.com, saying, “Forex is good job but it is not […]

Read more January 5

January 52008

Forex Technical Analysis for 01/0701/11 Week

EUR/USD trend: sell.GBP/USD trend: hold.USD/JPY trend: sell.EUR/JPY trend: sell. Floor Pivot Points: Pair 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res EUR/USD 1.4340 1.4454 1.4597 1.4711 1.4854 1.4968 1.5111 GBP/USD 1.9144 1.9409 1.9573 1.9838 2.0002 2.0267 2.0431 USD/JPY 102.01 104.96 106.78 109.73 111.55 114.50 116.32 EUR/JPY 151.94 155.84 157.96 161.86 […]

Read more