- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

January 5

January 52008

Rising Chile’s Inflation May Cause Another Rate Hike

Chile’s Consumer Price Index increased unexpectedly last month by more than analysts forecasted, increasing the odds that the Central Bank of Chile will raise the refinancing interest rate on the next week’s meeting to fight the record breaking high inflation. Consumer prices rose 0.5% in December after 0.8% growth in November, the National Statistics Institute‘s […]

Read more January 4

January 42008

Pound is Recovering on Good PMI Data

The Great Britain pound recovered the part of its recent losses against the euro, the dollar and the yen today after the U.K. services index for December (reported by the Chartered Institute of Purchasing and Supply) unexpectedly rose. Financial market analysts expected the PMI index (services index) to be reported at 51.6 for December, slightly lower than the November’s 51.9, but it has exceeded everyone’s expectations and was reported at 52.4, showing a gain of confidence in the services […]

Read more January 4

January 42008

EUR/USD Soars on Disastrous Employment Data

EUR/USD showed a growth of more than 100 pips in one hour immediately after the employment data from the United States were released today. While trading flat and even falling a little during the day, EUR/USD broke through its own record level setting a new historical maximum to 1.4824. Nonfarm payrolls growth was expected to fall from 94k in November to 70k in December, but the released data was a real […]

Read more January 3

January 32008

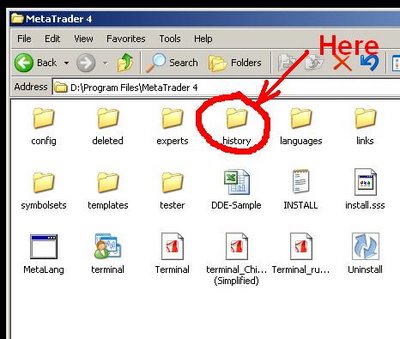

MetaTrader History Data Importing and Converting Tutorial for Quality Backtesting

Backtesting MetaTrader expert advisors on historical data is a good way to test a strategy. But testing on the limited data supplied with MT4 installation gives a very poor quality of testing (usually below 50%). So, how to achieve a 90% quality in backtesting of MT4 expert advisors? It’s not that hard really, just follow this simple tutorial and you will able to test any MetaTrader EA. 1. Download […]

Read more January 3

January 32008

Chinese Yuan at a Highset Rate against Dollar

According to the China Foreign Exchange Trading System, the dollar/yuan central parity rate was set at its record low since the scrap of peg to dollar – 7.2775; down from 7.2996 previous recent record level. Chinese government eliminated the yuan’s peg to the U.S. dollar and bound the national currency to trade-weighted basket of the […]

Read more January 2

January 22008

Aussie and Kiwi Gain on Higher Yields

Both Australian and the New Zealand dollars gained today on a presumption that the international investors bought Australia’s and New Zealand’s government bonds as their premiums yield more than their U.S. and Japanese counterparts. Yield differentials have been the major advantages of Aussie and kiwi for quite a while now. But yesterday and today the difference between Australian and U.S. two-year government notes reached the highest value in about four years, while New […]

Read more December 31

December 312007

Sudan Moves to Euro

The Central Bank of Sudan announced through circular (sent to Sudanese banks last Thursday) that starting from 2008 it will be denominating all currency accounting in euro instead of U.S. dollar. Central bank also informed other national banks that they are advised to stop using dollars and move to euro too. In their opinion, it […]

Read more December 31

December 312007

Happy Trading in 2008!

Soon the New 2008 Year will come and I just want to wish you a happy Forex/CFD/Stocks trading in the next year. Earn more than you’ve got in 2007, learn new strategies and open new opportunities on the Forex market! Never stop at what you’ve already mastered and you will find your own financial freedom!

Read more December 30

December 302007

Dollar is Losing Positions – IMF

The International Monetary Fund‘s report, released this Friday, shows that the specific part of U.S. dollar in world’s foreign currency reserves fell significantly in 2007. The U.S. dollar is losing its position as the international reserve currency giving it up to euro and Great Britain pound. In 2007 Q3 the dollar’s share in the Forex reserves was at 63.8%, it was 65.0% in the second quarter this year and it was 66.5% in third […]

Read more December 30

December 302007

Forecast for 2008 Forex, Oil, Interest Rates

OK, the New Year is coming close and as this year is ending it’s about time to try to forecast the future of the Forex market (and some other factors that influence Forex) for the year 2008. My last forecast (for 2007) didn’t get its own post on this blog, but I must admit that it was a disastrous attempt — I thought that dollar will start to grow and it lost more than 10% […]

Read more