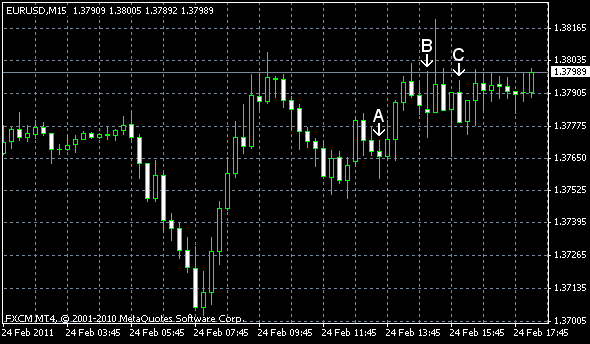

EUR/USD rose today for the second day on the speculation that the European Central Bank will raise the interest rates before the Federal Reserve. The currency pair also advanced on the speculation that the high oil prices can bolster the euro. The euro advanced sharply versus the dollar in the first half of the day, but later the rally stalled. EUR/USD currently trades near 1.3788.

Initial jobless claims decreased to 391k from the previous week’s revised figure of 413k. The median forecast was 403k. (Event A on the chart.)

Durable goods orders increased 2.7% in January, following three consecutive monthly decreases including the 0.4% December decrease. Analysts expected somewhat slower growth by 2.5%. (Event A on the chart.)

New home sales decreased to 284k from the revised December rate of 325k. The reading frustrated economists, who expected an increase to 330k. (Event B on the chart.)

Crude oil inventories increased by 0.8 million barrels and total motor gasoline inventories decreased by 2.8 million barrels last week. (Event C on the chart.)

Yesterday, a report on existing home sales was released, showing the increase to a seasonally adjusted annual rate of 5.36 million in January from a downwardly revised 5.22 million in December.

If you have any comments on the recent EUR/USD action, please, reply using the form below.