- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: February 28, 2011

February 28

February 282011

Canadian Dollar Rises on Positive GDP Report

The Canadian dollar strengthened today, rising for the fourth straight day against its US counterpart, as the report showed that the Canadian economy grew more than forecast in the last quarter of 2010. Canada’s gross domestic product rose 0.8 percent in the fourth quarter of the last year, led by exports, following a 0.4 percent gain in the previous quarter. The median forecast was 0.3 percent. Steve Butler, director of foreign-exchange trading at Bank of Nova […]

Read more February 28

February 282011

Pound Gains as Inflation Boosts Bets on Interest Rates Hike

The Great Britain pound advanced today on the speculation that Britain’s central bank will raise the interest rates to slow the growing inflation, which was bolstered by the surging oil prices. The inflation accelerated to 4 percent last month, the 14th straight month of a consumer prices increase, while the central bankâs target is just 2 percent. The anticipation of an interest rates increase boosted the sterling versus the dollar by 1.3 percent this month […]

Read more February 28

February 282011

New Zealand Dollar Gains on Asian Stocks & Trade Surplus

The New Zealand dollar advanced today, rising versus 15 of 16 most-traded currencies, as the nation’s traded balance unexpectedly posted a surplus in January and as the Asian stocks gained. The New Zealand traded balance had a massive deficit of NZ$264 million in December and analysts predicted the deficit to shrink to NZ$25 million in January. The report yesterday was better than even those optimistic forecasts as it showed the surplus of NZ$11 million last month, the first […]

Read more2011

Optimal Period for Strategy Testing

It’s hard to overestimate the importance of proper strategy testing in Forex trading. Just taking a strategy out of your head and applying it to a real money account usually leads to a total wipe. Unlike optimization, which is optional and sometimes dangerous, testing is crucial. But what period of time should be dedicated to strategy testing? It’s quite obvious that spending several days to try a strategy that uses weekly […]

Read more February 28

February 282011

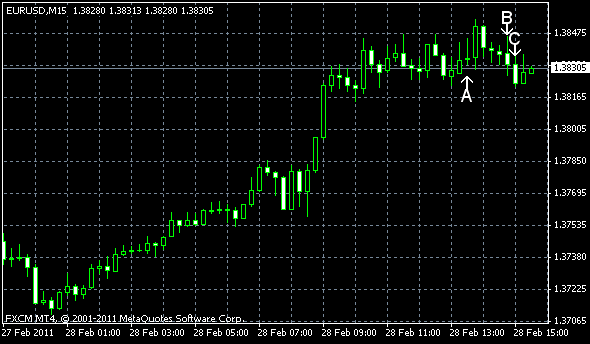

EUR/USD Advances as US Spending & Homes Sales Decline

EUR/USD rose today on the speculation that the Federal Reserve will maintain stimulus. The currency also rose as personal spending slowed and pending home sales declined more than predicted. The rally may slow as increasing personal income and improving business activity can support the dollar. EUR/USD currently trades at about 1.3827. Personal income increased 1.0% in January, following a growth by 0.4% in December. Personal income increased 0.2%, compared to the previous […]

Read more