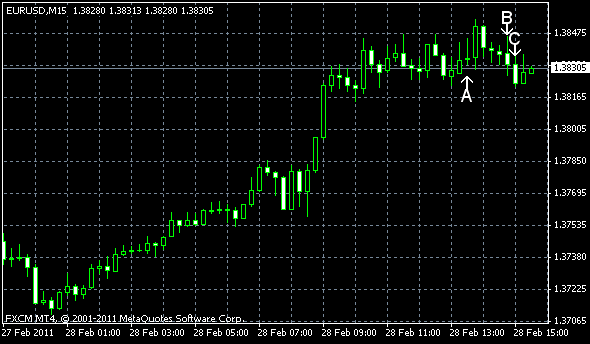

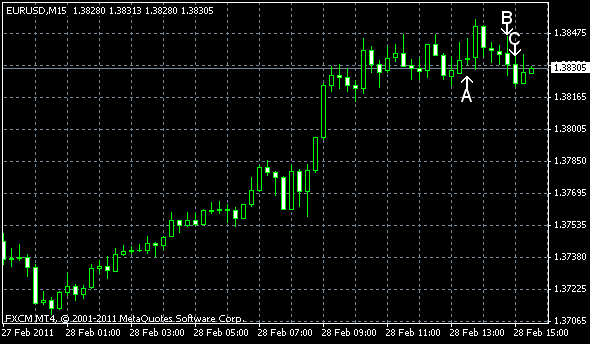

EUR/USD rose today on the speculation that the Federal Reserve will maintain stimulus. The currency also rose as personal spending slowed and pending home sales declined more than predicted. The rally may slow as increasing personal income and improving business activity can support the dollar. EUR/USD currently trades at about 1.3827.

Personal income increased 1.0% in January, following a growth by 0.4% in December. Personal income increased 0.2%, compared to the previous reading of 0.4%. Traders expected both income and spending to remain unchanged. (Event A on the chart.)

Chicago PMI indicator grew from 68.8 to 72.1 in February, rising to the highest level since July 1988 and expanding for the seventeenth consecutive month. The predictions were far more negative, promising a decline to 67.9. (Event B on the chart.)

Pending home sales index declined 2.8% in January, following the downwardly revised decline by 3.2% in December. The report frustrated analysts, who a drop by only 2.2%. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.