- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: March 1, 2011

March 1

March 12011

Australian Dollar Fell as Interest Rates Remain Unchanged

The Australian dollar dropped today as the policy makers of Australia’s central bank maintained the main interest rates unchanged on today’s meeting. The Reserve Bank of Australia decided today to leave the cash rate unchanged at 4.75 percent. Some traders have hoped that the inflation would encourage the policy makers to raise the rates, but central bank’s Governor Glenn Stevens said in his speech that “inflation is consistent with the medium-term objective […]

Read more March 1

March 12011

Swedish Krona Gains as Economic Growth Exceeds Forecasts

The Swedish krona strengthened today, rising to the highest level in two and a half years versus the US dollar, after the report showed that Sweden’s economic growth beat forecasts. The Swedish gross domestic product advanced 1.2 percent in the fourth quarter of 2010. The growth was slower than the 2.1 percent growth in the previous quarter, though bigger than the median forecast of 1 percent. Central bank Governor Stefan Ingves suggested yesterday […]

Read more March 1

March 12011

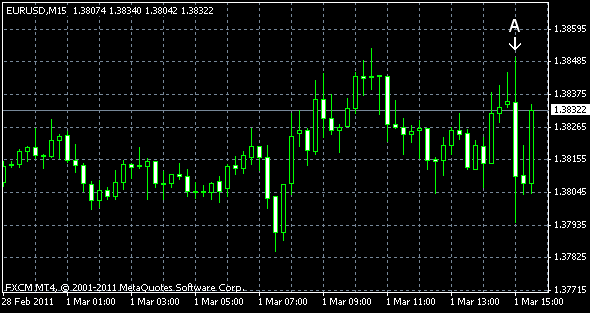

EUR/USD Goes Higher as Construction Spending Contracts

EUR/USD advanced today as the signs of slower economic recovery in the US spurred the speculation that the Federal Reserve will stick to its quantitative easing program, while the European Central Bank may raise its interest rates. Some analysts think, though, that the talks about higher interest rates in Europe aren’t based on the fundamentals and are nothing but optimistic rhetoric. EUR/USD trades at 1.3826 now. ISM PMI advanced to 61.4% […]

Read more March 1

March 12011

Inflation Pressure Makes Euro Stronger

The euro advanced on the speculation that the accelerating inflation will make the European Central Bank to raise the interest rates before the Federal Reserve. The Eurozone annual inflation rose to 2.3 percent in January from 2.2 percent in December 2010. The consumer prices remained above the ECB target of 2 percent for the second month. The rising consumer prices spurred the speculation that the inflation pressure will prompt the ECB to increase the rates. Most analysts, though, […]

Read more