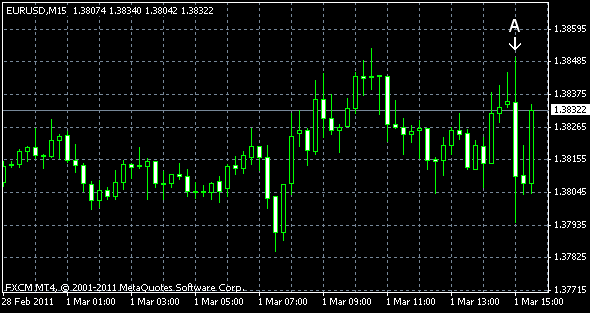

EUR/USD advanced today as the signs of slower economic recovery in the US spurred the speculation that the Federal Reserve will stick to its quantitative easing program, while the European Central Bank may raise its interest rates. Some analysts think, though, that the talks about higher interest rates in Europe aren’t based on the fundamentals and are nothing but optimistic rhetoric. EUR/USD trades at 1.3826 now.

ISM PMI advanced to 61.4% in February, rising for 19th consecutive month. Analysts expected the index to be at 60.9%, almost unchanged from the January value of 60.8%. (Event A on the chart.)

Construction spending declined 0.7% in January. The decline was smaller than the December drop by 1.6% (revised from 2.5%), but bigger than predicted 0.4% contraction. (Event A on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.