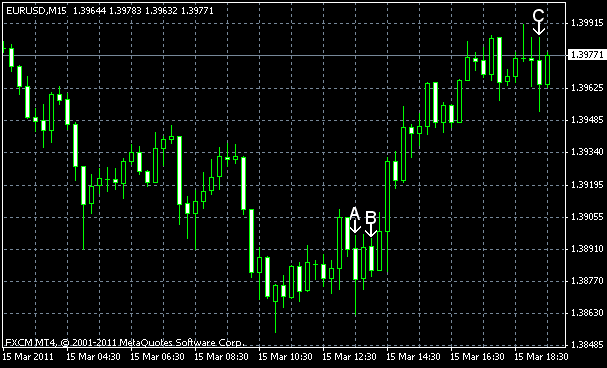

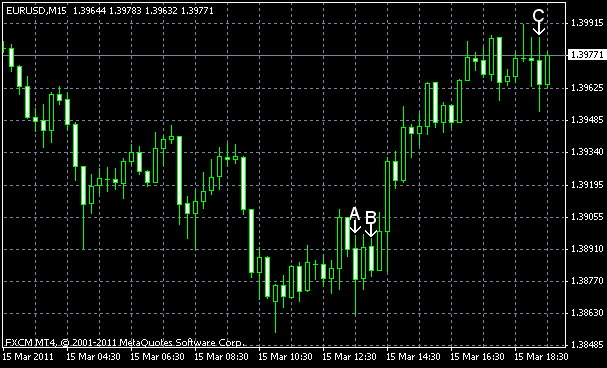

EUR/USD gained yesterday as the European Union Summit gave hope that the debt problems of the European countries may be resolved, but the currency pair slumped heavily on today’s trading session. Currently the euro regained much of its strength. The currency pair may advance further as the Federal Open Market Committee maintained its record low interest rates and the bonds purchasing program. EUR/USD currently trades near 1.3993 now after it tumbled earlier to 1.3855.

NY Empire State Manufacturing index increased from 15.4 to 17.5 in March. The actual value was above forecast that predicted a value of 16.2. (Event A on the chart.)

US import and export prices rose in February. Import prices rose 1.4%, following the revised 1.3% advance in January. The growth was bigger than expected 0.9% increase. Export prices increased 1.2% after rising 1.3% in the previous month as both agricultural and nonagricultural export prices advanced. (Event A on the chart.)

Net foreign purchases of

The meeting of the Federal Open Market Committee was held today. The Committee noted in its statement that “conditions in the labor market appear to be improving gradually”, yet “the unemployment rate remains elevated”, while “the housing sector continues to be depressed”. Regarding the inflation the Committee said:

The recent increases in the prices of energy and other commodities are currently putting upward pressure on inflation. The Committee expects these effects to be transitory, but it will pay close attention to the evolution of inflation and inflation expectations.

The Committee decided to continue expanding its holdings of securities and to keep the target range for the federal funds rate at zero to 0.25%. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.