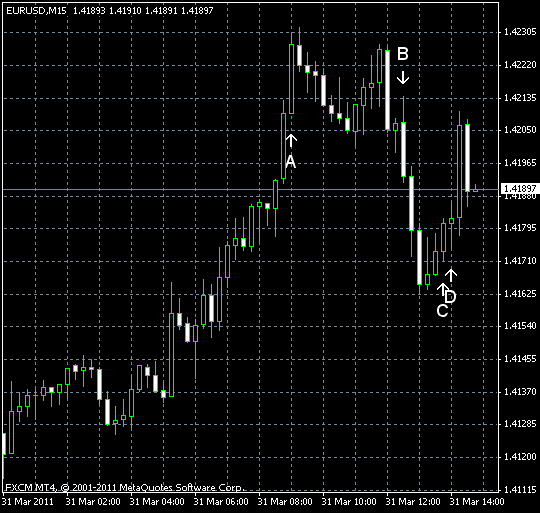

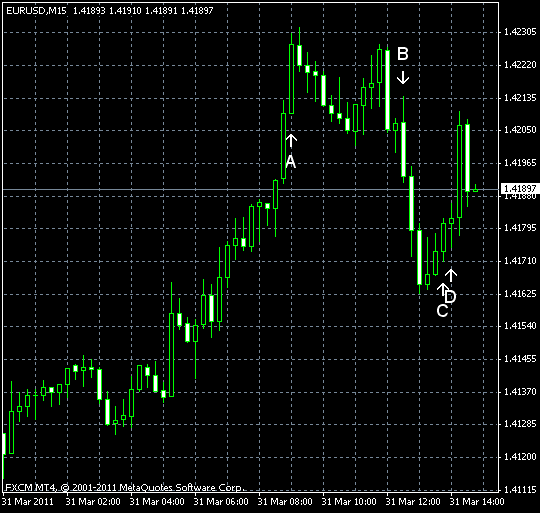

EUR/USD recovered after the previous decline on today’s trading session as the Eurozone consumer prices grew, while the US jobless claims and factory orders posted

Initial jobless claims was 388k (seasonally adjusted) in the week ending March 26. That’s lower than the previous week’s revised figure of 394k, but above the forecast value of 379k. (Event B on the chart.)

Chicago PMI was at 70.6 in March, slightly above the predicted reading of 70.1. The index was down from 71.2 in February, but still indicates increasing economic activity. (Event C on the chart.)

Factory orders decreased 0.1% in February, following three consecutive increases in the previous months, including the increase by 3.3% in January. Forecasts promised a growth by 0.7%. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.