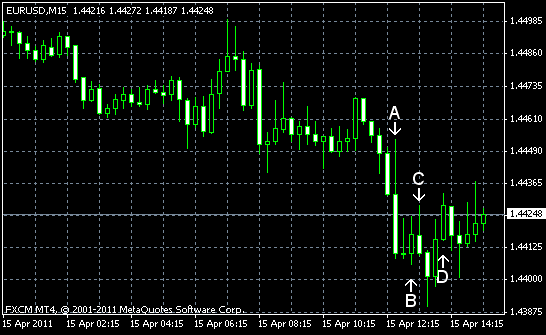

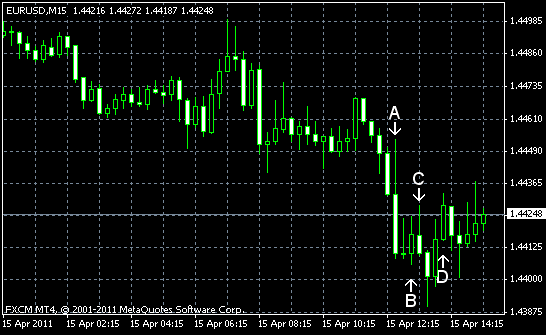

EUR/USD was tumbling today, but now has found support and tries to decide where to go next. The euro was hurt as Moody’s Investor Service cut Ireland’s credit rating and kept the outlook on negative. Today’s reports from the US showed robust growth of the industrial output and the manufacturing, as well as the unexpectedly strong improvement of the consumer sentiment. EUR/USD trades now at 1.4434.

CPI grew 0.5% in March, in line with forecasts. In February the index grew with the same 0.5% pace. (Event A on the chart.)

Empire State Manufacturing Index rose to 21.7 in Apirl, posting the fifth straight monthly gain. The index was at 17.5 in March and was expected to go down to 17.1. (Event A on the chart.)

Net foreign purchases of

Industrial production and capacity utilization rose in March. Industrial production grew 0.8%, compared to the expected value of 0.5% and the February growth by 0.1%. Capacity utilization increased from 76.9% in February to 77.4% last month as was expected by Forex traders. (Event C on the chart.)

Preliminary Michigan Sentiment Index rose from 67.5 in March to 69.6 in April. Forecasters promised an increase to 68.7. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.