EUR/USD erased previous losses and advanced to the highest level since January 2010 today as investors continue to bet that the European Central Bank will raise its key lending rate on the next policy meeting. The fundamentals remain unfavorable for the euro as the producer prices in Germany, the healthiest economy in the European Union, rose only 0.4 percent on

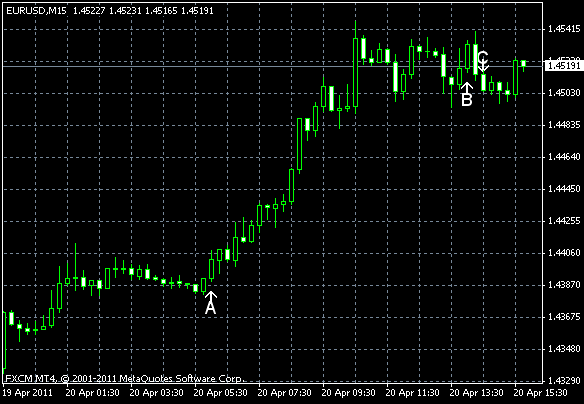

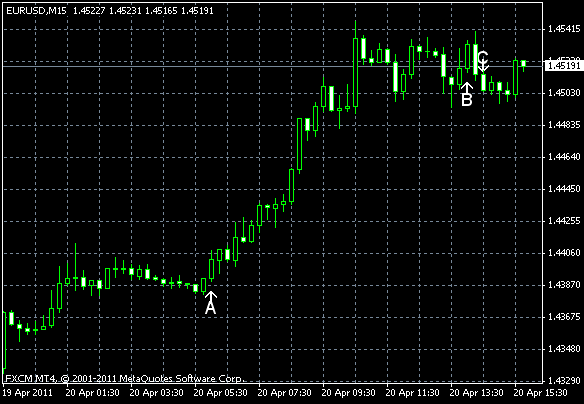

Existing home sales increased to a seasonally adjusted annual rate of 5.10 million in March from an upwardly revised 4.92 million in February. Forecasts pointed at 5.02 million as an expected value. (Event B on the chart.)

US crude oil inventories decreased by 2.3 million barrels from the previous week and are in the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 1.6 million barrels last week and are in the lower limit of the average range. (Event C on the chart.)

Yesterday, a report on housing starts and building permits was released, showing the growth in March. Building permits grew to 594k in March from 534k in February. Housing starts advanced from 512k in February to 549k in March. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.