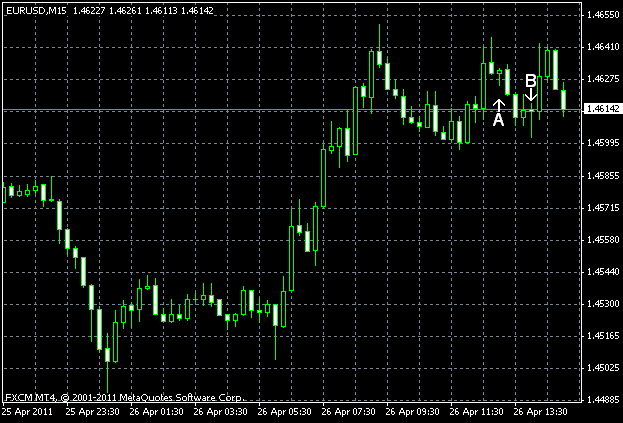

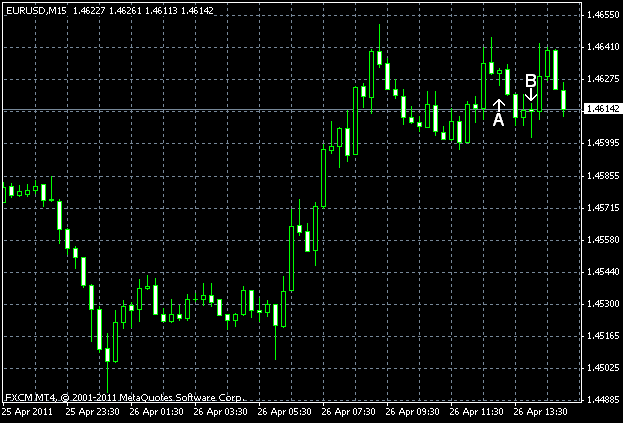

Mixed fundamental reports coming out from the US today pushed the EUR/USD currency pair up to a new record maximum level since late December 2009. While there are positive news about the consumer confidence levels and the optimism from the yesterday’s new home sales report, the

S&P/

Consumer confidence rose from 63.8 (adjusted positively from 63.4) to 65.4 in April in the United States. A growth to 64.5 was expected by the traders. (Event B on the chart.)

Richmond Fed manufacturing index surprisingly declined from 20 to 10 in April. It was expected to remain unchanged this month. (Event B on the chart.)

Yesterday, a report on new home sales in the US was released. They rose from 270k to 300k annual

If you have any comments on the recent EUR/USD action, please reply using the form below.