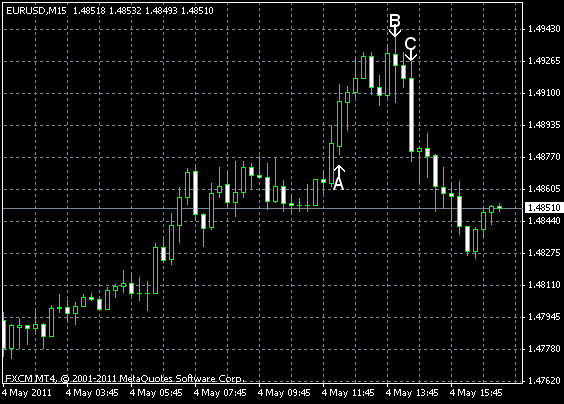

EUR/USD rose today on speculation that the European Central Bank will raise its main interest rate tomorrow, while the Federal Reserve won’t have courage to scrap its stimulating program. The currency pair surged in the first half of the day, but after 14:00 started a steady decline. Currently the euro struggles to stop this drop. The economic data from the US today was worse that Forex market participants have anticipated, but the report about factory orders yesterday was much better than was forecast. EUR/USD trades now at 1.4850 after it jumped to the intraday high of 1.4939.

ADP employment increased by 179k from March to April, while the increase from February to March was revised up to 207k. Analysts said that change last month was by 200k. (Event A on the chart.)

ISM services was at 52.8% in April, down from 57.3% in March. The reading frustrated forecasters as they expected an increase to 57.9%. The services industries still grow, but pace of growth slowed. (Event B on the chart.)

Crude oil inventories increased by 3.4 million barrels from the previous week and are above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 1.0 million barrels last week and are just under the lower limit of the average range. (Event C on the chart.)

Yesterday, a report on factory orders was released, showing an increase by 3.0% in March, following the rise by 0.7% in February. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.