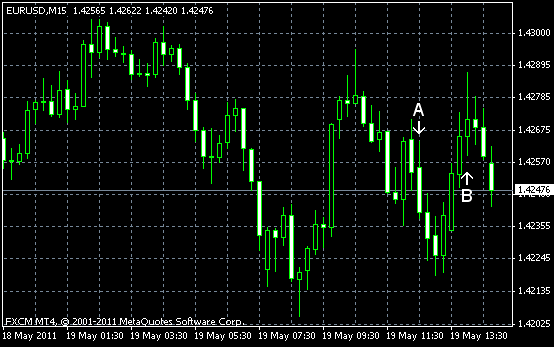

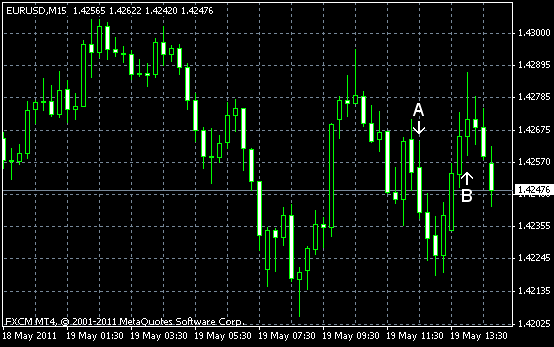

EUR/USD jumped up and down today. The euro weakened the decline of stocks and commodities drive investors to safe assets, but the dollar also loses strength as the US economy continues to show signs of weakness. The US jobless claims decreased last week and that was good news, but virtually all other reports today were very bad. EUR/USD trades now near its opening level of 1.4247.

Initial jobless claims decreased to 409k last week from the previous week’s revised figure of 438k, posting the biggest decline than the expected drop to 421k. (Event A on the chart.)

Philadelphia Fed Manufacturing Index decreased to 3.9 in May from 18.5 in April, the lowest level since October 2010. A disastrous result, considering that forecasts put the index to 20.2. (Event B on the chart.)

US leading indicators declined 0.3% in April, following a 0.7% increase in March. Another

Yesterday, the report on crude oil inventories was released, showing that the stockpiles of crude remained unchanged from the previous week, while total motor gasoline inventories increased by 0.1 million barrels last week.

FOMC meeting minutes were also released yesterday, but they didn’t gave any particularly new information. The inflation is going higher because of higher food and fuel prices, but this influence is considered temporary, so no change to the monetary policy is expected.

If you have any comments on the recent EUR/USD action, please f=”#commentstart”>reply using the form below.