- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 16, 2011

June 16

June 162011

US & Europe Drain Loonie’s Strength

The problems of Europe still plague markets and the unfavorable reports showed that the US manufacturing weakened. The resulting shift of markets to risk aversion mode was negative to the Canadian dollar. The New York Manufacturing Index fell to -7.8 in June from 11.9 in May and the Philly Fed Manufacturing Index slid to -7.7 from 3.9, while market participants expected the manufacturing to improve this month. The Standard & Poorâs 500 Index was up […]

Read more June 16

June 162011

SNB Keeps Rates Unchanged, Franc Climbs to New Record vs. Euro

The Swiss National Bank left its main interest rates unchanged today and predicted that the inflation will grow. The Swiss franc jumped, reaching the new all-time high versus the euro. The SNB maintained its key Libor rate at 0.25 percent today. Philipp Hildebrand, the Chairman of the SNB Governing Board, said in his introductory remarks at the press-conference that the economic recovery persists and the impact of the strong currency on the nation’s exporters is offset […]

Read more June 16

June 162011

Great Britain Pound Goes Lower as Retail Sales Slump

The Great Britain dropped today after the report showed that the decline of retail sales in the UK last month was biggest that anticipated by analysts. The retail sales slid 1.4 percent in May from April, compared to the forecast of a 0.5 percent fall. The drop was both in value and volume. The report suggested that the sales fell because of “the economic climate, for example increasing fuel prices and uncertainty over job prospects and pay”. GBP/USD […]

Read more June 16

June 162011

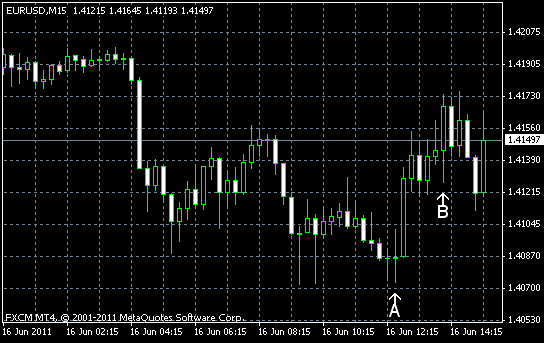

EUR/USD Slows Decline, Remains Weak

EUR/USD slowed its decline, but the euro is far from being strong. Speculations that Greece’s government may be disbanded and that the nation may face default aren’t helping the currency. The US dollar, on the other hand, is supported by the fundamentals. The reports were very good today, with the notable exception of the manufacturing indicator of the Philadelphia Fed that turned negative this month. EUR/USD currently trades near 1.4145 […]

Read more