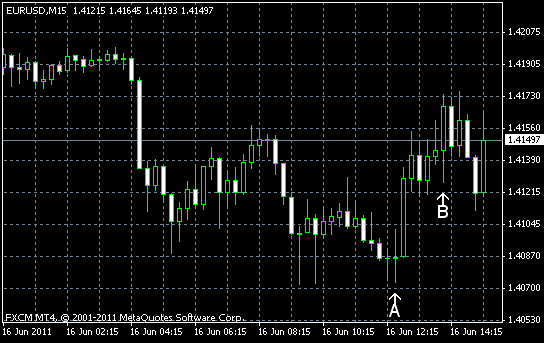

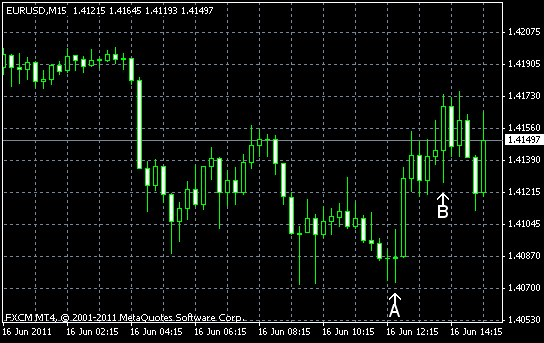

EUR/USD slowed its decline, but the euro is far from being strong. Speculations that Greece’s government may be disbanded and that the nation may face default aren’t helping the currency. The US dollar, on the other hand, is supported by the fundamentals. The reports were very good today, with the notable exception of the manufacturing indicator of the Philadelphia Fed that turned negative this month. EUR/USD currently trades near 1.4145 after falling earlier to 1.4072.

Housing starts and building permits advanced in May and were above forecasts. Housing starts were at a seasonally adjusted annual rate of 560k, while they were expected at the April level of 540k. Building permits were at a seasonally adjusted annual rate of 612k, compared to the expected drop to 550k from 560k in April. (Event A on the chart.)

Initial jobless claims dropped to 414k from 430k last week. Analysts’ estimate was 421k. (Event A on the chart.)

US

Philadelphia Fed Manufacturing Index decreased to -7.7 in June from 3.9 in May, posting its first negative reading since last September. That’s a very terrible figure compared to the expected reading of 7.1. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.