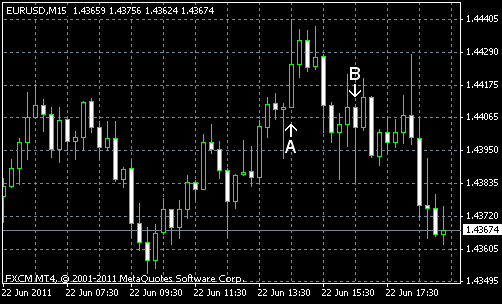

EUR/USD rose today after Greece’s Prime Minister won a confidence vote, but erased gains on the speculation that the Greek government will struggle to implement austerity measures, which are very unpopular among Greece’s population. The currency pair remained weak even after the US central bank maintained the interest rates and signaled that it will continue to stimulate the US economy. EUR/USD trades near 1.4364 after rising to the intraday high of 1.4441.

US crude oil inventories decreased by 1.7 million barrels and total motor gasoline inventories decreased by 0.5 million barrels last week. (Event A on the chart.)

The Federal Open Market Committee kept its key Federal Funds Rate near zero, as was expected by Forex market participants, and released rather dovish statement (Event B on the chart.):

The Committee continues to anticipate that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate for an extended period. The Committee will complete its purchases of $600 billion of

Yesterday, a report on existing home sales was released, showing the drop to the seasonally adjusted annual rate of 4.81 million in May from the downwardly revised 5.00 million in April (Not shown on the chart.).

If you have any comments on the recent EUR/USD action, please, reply using the form below.