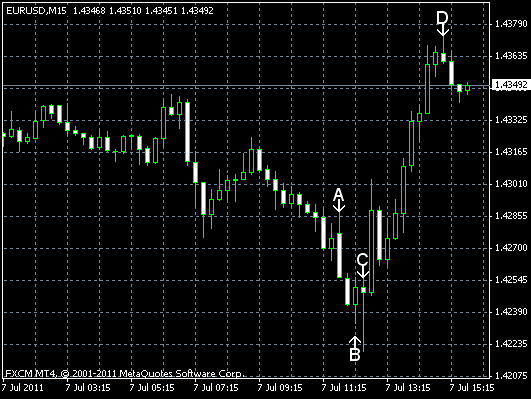

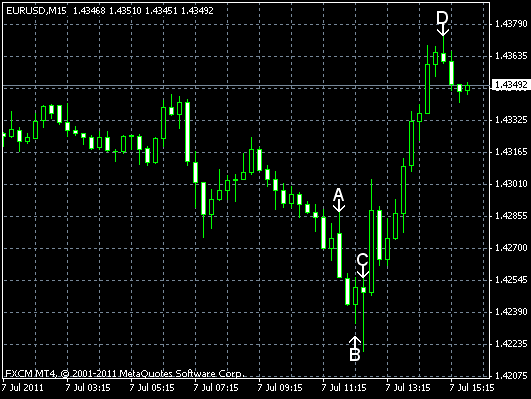

EUR/USD advanced today as the increase of interest rates by the European Central Bank overshadowed the positive reports about the employment in the US. (Event A on the chart.) The currency pair hasn’t immediately reacted to the news and continued its decline at first, but later surged above the opening rate. The US jobless claims were near the median forecast, but the ADP employment report was much better than predictions of analysts. EUR/USD trades now at 1.4348 after falling to 1.4220.

ADP employment grew by 157k in June from May. That’s compared to the expected change by 67k and the May change by 36k. (Event B on the chart.)

Initial jobless claims was at 418k last week, near the market expectations of 421k, falling from the previous week’s 432k. (Event C on the chart.)

Crude oil inventories decreased by 0.9 million barrels from the previous week and are above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 0.6 million barrels last week and are in the lower limit of the average range. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.