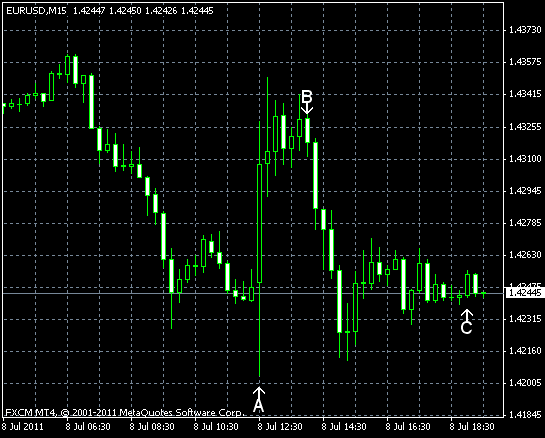

EUR/USD fell today on concerns about indebted nations of the European Union. The currency pair jumped after the report showed that the US nonfarm payrolls grew last month grew in June with slowest pace in nine months and the unemployment rate unexpectedly increased, but quickly erased gains and resumed its decline. EUR/USD trades now at 1.4247.

Nonfarm payroll was almost unchanged in June, showing an increase by only 18k, even less than small increase by 25k (revised from 54k) in May. The actual reading was nowhere near the median forecast of 97k. Unemployment rates increased to 9.2%, while it was expected to stay at 9.1%. (Event A on the chart.)

Wholesale inventories edged up 1.8% in May, following the 1.1% rise in April. Analysts expected a 0.6% increase. (Event B on the chart.)

US consumer credit went up $5.1 billion in May from April, exactly as market analysts predicted, following the advance by $5.7 billion (revised from $6.2 billion) in April from March. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.