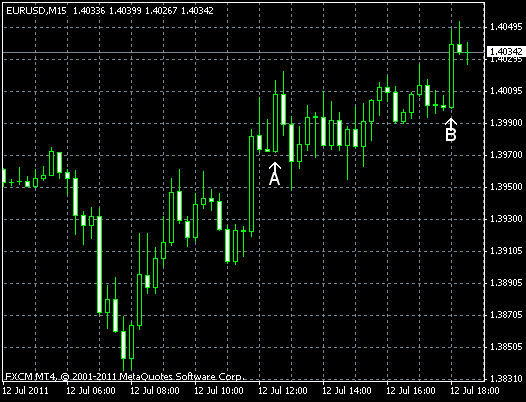

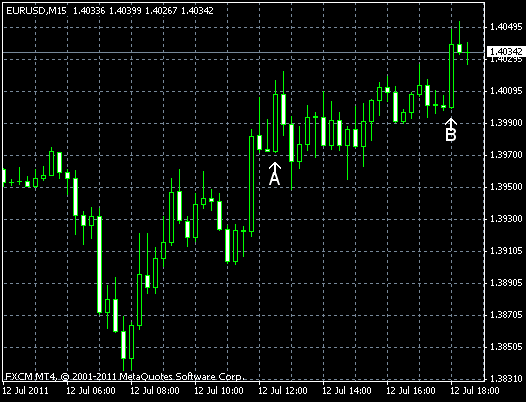

EUR/USD posted a huge slump today on increasing concerns about the debt crisis in Europe. Italy may need help and some experts claim that in such case the European Union would be required to increase its bailout fund. The currency pair erased its losses after the report showed that the US trade balance deficit increased more than predicted. EUR/USD trades now at 1.4034, near its opening level of 1.4029, after it tumbled as low as 1.3836 earlier.

The US trade balance posted a deficit of $50.2 billion in May, up from $43.6 billion in April, revised. Traders hoped that the deficit would widen to only $44.1 billion. (Event A on the chart.)

The minutes of the Federal Open Market Committee was released today, showing that the Committee members are divided on whether monetary stimulus should be reduced or increased. (Event B on the chart.) The minutes said:

On the one hand, a few members noted that, depending on how economic conditions evolve, the Committee might have to consider providing additional monetary policy stimulus, especially if economic growth remained too slow to meaningfully reduce the unemployment rate in the medium run. On the other hand, a few members viewed the increase in inflation risks as suggesting that economic conditions might well evolve in a way that would warrant the Committee taking steps to begin removing policy accommodation sooner than currently anticipated.

If you have any comments on the recent EUR/USD action, please, reply using the form below.