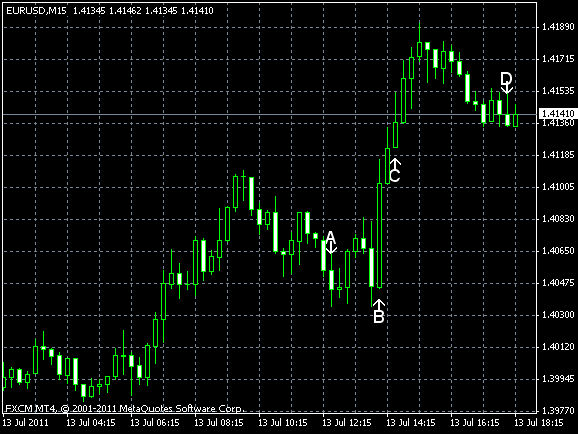

EUR/USD fell today after Federal Reserve Chairman Ben S. Bernanke suggested in his speech that the US central bank is ready for additional stimulating measures if that would be necessary. (Event B on the chart.) The fundamentals showed today positive tendencies in the US economy, yet import prices posted the first decline in a year. EUR/USD currently trades near 1.4142.

A report on import and export prices was released today. Import prices fell 0.5% in June, posting the first decline since June 2010. Market participants expected a decline to 0.7%, while the prices increased 0.1% in May. Export prices edged up 0.1% in June, following the advance by 0.2% in May. (Event A on the chart.)

Crude oil inventories decreased by 3.1 million barrels from the previous week and are above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 0.8 million barrels last week and are in the lower limit of the average range. (Event C on the chart.)

The treasury budget deficit shrank to $43.1 billion in June from $57.6 billion in May. That’s a better reading compared to median forecast that promised an increase to $68.0 billion. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.