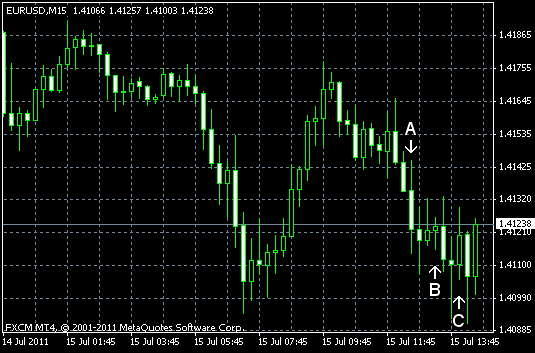

EUR/USD fell today for the second day as Fitch Rating downgraded Greece’s credit rating yesterday, increasing worries about the debt crisis in Europe. The current performance of the currency pair is result of a weak euro, not a strong dollar. The US currency isn’t supported by fundamentals as virtually all economic reports today were negative. EUR/USD currently trades near 1.4122.

CPI fell 0.2% in June, following the advance by 0.2% in May. Analysts expected a drop by 0.1%. The major factor in the decline was the drop of the gasoline index. (Event A on the chart.)

NY Empire State Index was at -3.8 in July, showing that conditions for New York manufacturers deteriorated for the second straight month. The index was above the June value of -7.8, but below the predicted figure of 4.5. (Event A on the chart.)

Industrial production and capacity utilization in June was below forecasts. Industrial production increased 0.2% after falling 0.1% in May, while forecast promised a 0.4% growth. Capacity utilization remained unchanged at 76.7 percent, even though forecast promised an increase to 77.0%. (Event B on the chart.)

Michigan Sentiment Index dropped from 71.5 to 63.8, compared to the expected reading of 72.5. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.