The dollar fell against the euro today, as the positive employment report from the US decreased the

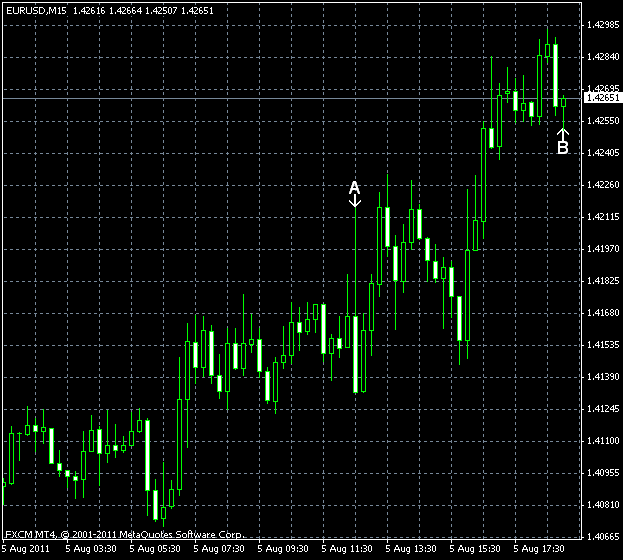

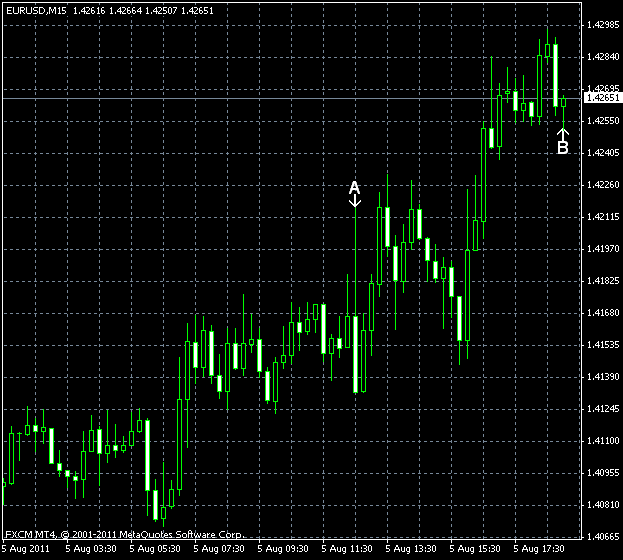

Nonfarm payrolls report in the US showed a 117k gain in July, following 46k gain in May (revised positively from 18k). The median forecast for this important US employment indicator was at 85k. The overall unemployment rate went down from 9.2% to 9.1%, while the forecasts were pointing at 9.2%. (Event A on the chart.)

Consumer credit unexpectedly increased by $15.5 billion in June, following $5.1 billion gain in May. It was expected to rise be $5 billion this time. (Event B on the chart.)

Yesterday, the initial jobless claims report was released in the United States. It showed 400k claims for the last week, which is better than both the previous value of 401k and the forecast of 405k. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.