- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: August 9, 2011

August 9

August 92011

Pound Drops with Higher Trade Deficit

The Great Britain pound dropped after macroeconomic data provided today some unpleasant surprises, including the unexpected growth of trade balance deficit and decline of manufacturing. The UK trade balance deficit widened to £8.9 billion in June from £8.5 billion in May. Traders hoped for decrease of the deficit to £8.2 billion. Manufacturing production declined with the annual rate of 0.4 percent in June. The contraction followed the advance by 1.8 percent in the month before. Market […]

Read more August 9

August 92011

Fed Plans Keep Zero Rates till 2013, Dollar Hurt

The US dollar slumped against some other currencies, including the euro, the yen and the franc, after the Federal Reserve kept its key Federal Fund rate near zero and signaled that it may keep interest rates exceptionally low till mid-2013. The Federal Open Market Committee said in its statement that “economic growth so far this year has been considerably slower than the Committee had expected”. […]

Read more August 9

August 92011

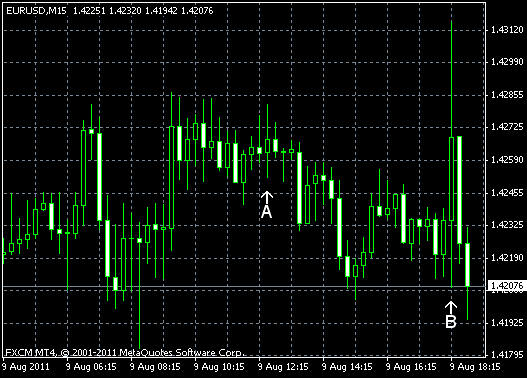

FOMC May Keep Zero Rates for 2 Years, EUR/USD Up

EUR/USD currency pair was slowly declining today, but jumped after the Federal Open Market Committee maintained the interest rates near zero and suggested that it may keep the exceptionally low rates for the next two years. The extremely dovish statement wasn’t very helpful for the euro, though, as it erased its gains, caused by the FOMC decision, almost immediately. The currency pair still remains above the opening rate at present. […]

Read more August 9

August 92011

Australian Dollar Attempts Stop Decline, Fails

The Australian dollar attempted to pare its losses today after Asian stocks rebounded, but this attempt wasn’t successful, meaning that the currency heads for a ninth straight session of losses. The MSCI Asia Pacific Index posted a decline of 1.7 percent, rebounding from the drop by 5.5 percent. The Australian currency also rebounded from its intraday decline by 2.5 percent against the US dollar, but currently resumed movement to the downside. […]

Read more August 9

August 92011

Impact of BoJ Intervention on Yen Wanes

The Japanese yen jumped against all other most-traded currencies today as traders fled to safety of the yen, fearing the financial problems of the US and Europe. The Japanese policy makers signaled that they may take steps to curb gains of the currency. In fact, the Bank of Japan already intervened on August 4, but the impact of the move almost waned at present. This situation isn’t unlike the one in Switzerland, where the central bank also fights with […]

Read more