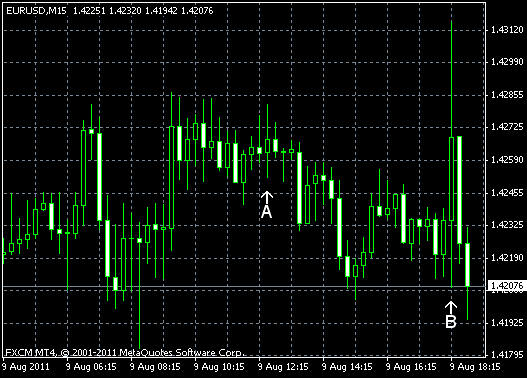

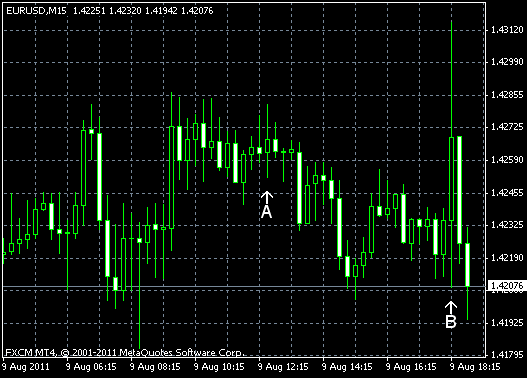

EUR/USD currency pair was slowly declining today, but jumped after the Federal Open Market Committee maintained the interest rates near zero and suggested that it may keep the exceptionally low rates for the next two years. The extremely dovish statement wasn’t very helpful for the euro, though, as it erased its gains, caused by the FOMC decision, almost immediately. The currency pair still remains above the opening rate at present.

Nonfarm productivity contracted 0.3%, according to the preliminary report. The rate of decline was expected to remain at the same 0.6% as in the previous quarter. (Event A on the chart.)

The Federal Open Market Committee released its statement today. (Event B on the chart.) It said that economic growth has slowed, while labor and housing markets remained weak. As a conclusion, FOMC announced:

To promote the ongoing economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent. The Committee currently anticipates that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.

If you have any comments on the recent EUR/USD action, please reply using the form below.