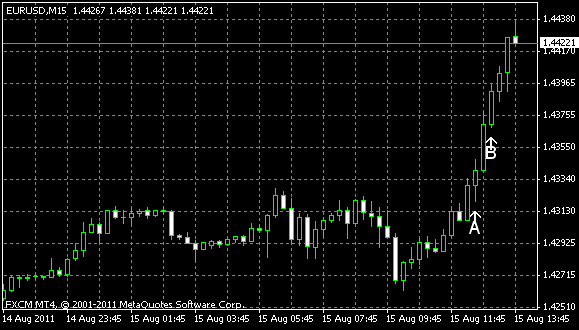

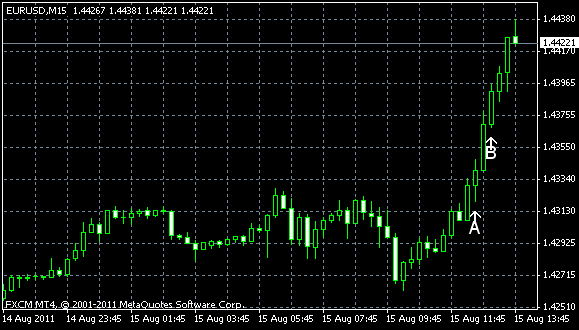

This day was rather unfavorable for the US dollar as fundamental reports were far worse than was expected. EUR/US jumped as a result. Market analysts promised that US manufacturing would expand and purchases of US

NY Empire State Index slid to -7.7 in August from -3.8 in July, indicating that conditions for New York manufacturers continues to worsen. That’s can be considered a disastrous result, especially compared with the anticipated advance to 0.5. (Event A on the chart.)

Net foreign purchases of US Treasuries decreased to $3.7 billion in June from $24.2 billion in May. That’s another depressing report, showing that market participants were too optimistic to expect an increase to $30.4 billion. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.