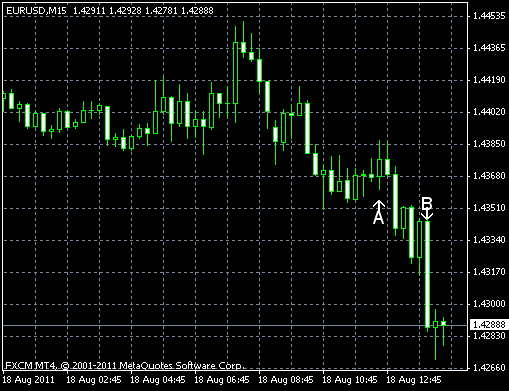

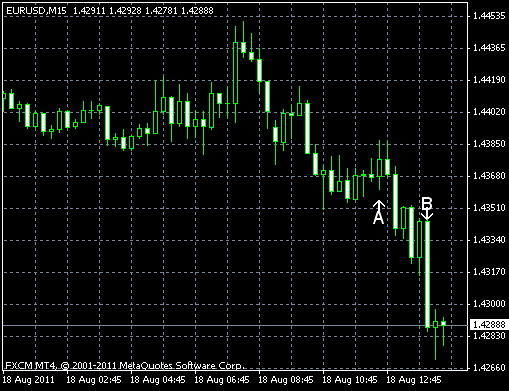

EUR/USD tumbled today as inflation in the US accelerates, while concerns about the debt problems in Europe persist. US leading indicators also rose. Yet there were plenty of bad news for the United States. Jobless claims rose and existing home sales fell. Manufacturing was particularly bad, as manufacturing index of Philadelphia Fed registered an unexpected and massive slump.

Initial jobless claims were higher at 408k in the week ended August 13, compared to 399k in the week before. The expected value was 402k. (Event A on the chart.)

CPI rose 0.5% in July, compared to a 0.2% increase predicted by analysts. That’s an improvement after the decline by 0.2% in June. (Event A on the chart.)

Existing home sales were at 4.67 million in July. That was a decline from June reading of 4.84 million (revised upwardly from 4.77 million) and, as such, an unpleasant surprise to market participants, who counted on increase to 4.91 million. (Event B on the chart.)

Manufacturing provided even more unpleasant surprise as Philadelphia Fed Manufacturing Index sank to -30.7 in August (the lowest level since March 2009). Economists, who expected a small increase from July figure of 3.2 to 4.0, must’ve been shocked by this report. (Event B on the chart.)

Leading indicators climbed 0.5% in July after 0.3% growth in June. Median forecast was 0.2% advance. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.