EUR/USD posted a biggest drop in a month today as European Central Bank President

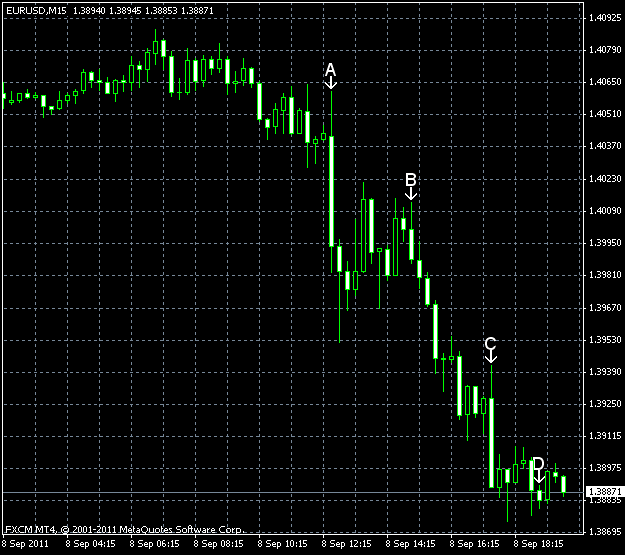

US trade balance deficit was $44.8 billion in July, down from $51.6 billion in June. Market participants expected higher deficit of $50.6 billion. (Event A on the chart.)

Initial jobless claims increased to 414k last week from the previous week’s figure of 412k (revised from 409k), instead of going down to 407k as was predicted by market analysts. (Event A on the chart.)

Crude oil inventories decreased by 4.0 million barrels and total motor gasoline inventories increased by 0.2 million barrels last week. (Event B on the chart.)

Consumer credit edged up to $12.0 billion in July from $11.3 billion in June (revised from $15.5 billion), while traders expected a decline to $6.3 billion. (Event D on the chart.)

On September 6, a report about ISM services PMI was released, showing a jump from 52.7% to 53.3%. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.