- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: October 27, 2011

October 27

October 272011

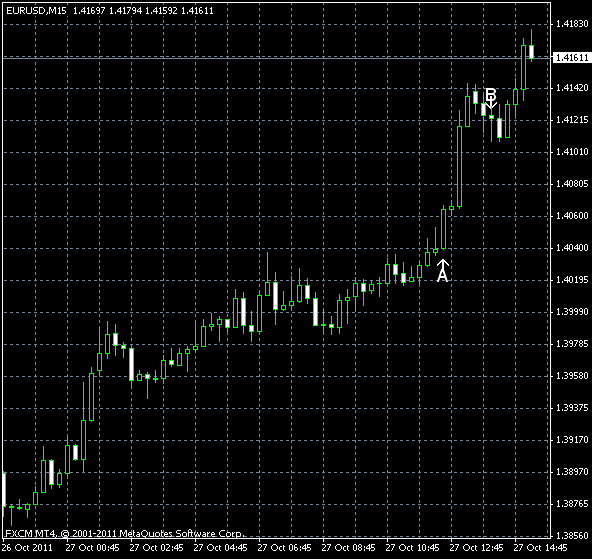

EUR/USD Surges Past 1.41 Level on Eurozone Deal

Forex traders are almost delirious with happiness today as eurozone leaders announced a deal to contain the sovereign debt crisis — at least for now. Private bondholders will be taking a nominal 50% haircut on Greek debt, and everyone seems happy about it. For now, this has propelled the euro higher in Forex trading. EUR/USD has surged beyond the 1.41 level. However, there are some worries that the situation […]

Read more October 27

October 272011

Rand Jumps on Positive News from Europe

It looks like the European leaders have reached consensus about some questions they were discussing during their meetings. The signs of progress in resolving Europe’s crisis were welcomed by traders and riskier currencies, including the South African rand, gained. Traders were holding breath as the European Union chiefs were struggling to find a cure for the ailments of the EU economy. Absence of any clear plans to resolve the problems was frustrating and depressing […]

Read more October 27

October 272011

Canadian Dollar Strengthens against US Dollar

As the Europeans announce a debt agreement, the Canadian dollar is strengthening against the US dollar. It’s been more than a month since the loonie has reached this level against the greenback, but some think that the strength is more a function of general greenback weakness today. With the Bank of Canada forecast for Canadian economic growth cut earlier this week, there isn’t a whole to cheer about in terms of the loonie. Indeed, […]

Read more October 27

October 272011

EU Closer to Agreement on Debt, Korea’s Won Gets Stronger

The South Korean won climbed today on the positive outlook for the economy of Asia’s nations and the signs of progress in making the plans to resolve the sovereign debt issues in Europe. French President Nicolas Sarkozy said today that the European Union leaders convinced banks to write down 50 percent of the Greek debt. China commented that the agreement will bring “new vitality into European integration”. Sarkozy also said the International Monetary Fund will […]

Read more October 27

October 272011

EUR/USD Surges as EU Leaders Make Headway in Rescue Plans

EUR/USD surged today to the highest level since September 7 as the European leaders made progress in devising plans for helping the most-indebted members of the European Union. The EU chief agreed to increase the bailout fund and to write down part of Greece’s debt. The US economy was expanding with faster pace in the past three months, but the reports about the housing market make traders scratch their heads. The bad report was followed by the good […]

Read more October 27

October 272011

RBNZ Signals About Possible Interest Rates Hike, NZD Higher

The New Zealand dollar gained today, extending its rally for the second day, after the Reserve Bank of New Zealand key its target interest rate unchanged, but suggested that an increase is possible in the future. The RBNZ left its key Official Cash Rate (OCR) unchanged at 2.5 percent. Reserve Bank Governor Alan Bollard explained the factors that currently prevent the central bank from tightening the monetary policy: […]

Read more