- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: November 1, 2011

November 1

November 12011

UK Pound Lower Against US Dollar, But Up Against Euro

UK pound is down against the US dollar today — but what high beta currency isn’t? With all of the uncertainty surrounding Greece, China and MFGlobal, it’s really no surprise that stocks are being routed, and the pound is following suit. However, the pound is mainly down against the US dollar and the Japanese yen as investors look for safe haven. Against other currencies, the UK pound seems […]

Read more November 1

November 12011

US Dollar Surges as Financial Markets Retreat

US dollar is surging today in Forex trading, heading higher as financial markets retreat on the latest debacle in the Greek financial tragedy. In a surprise move, Greece has agreed to call a referendum on the rescue plan, and that has sparked global fears that Greece will just default. A referendum on the Greece rescue plan would mean that citizens — many of whom have been protesting austerity measures necessary to get the bailout […]

Read more November 1

November 12011

Norway Krone Falls as Central Bank Intervenes

The Norway krone declined today after the Norway central bank announced its plans to purchase foreign currency, weakening the nation’s currency. Norges Bank announced yesterday that it’s going to buy foreign exchange equivalent to 1.6 billion kroner per day for the Government Pension Fund Global. The announced size of purchase was bigger than most analysts have anticipated. Fed Vice Chairman Janet Yellen and other central bank […]

Read more November 1

November 12011

Russia Ruble Falls Ahead of Greek Referendum

The Russian ruble fell today as the concerns about the global economic slowdown weakened crude oil — the main nation’s source of export revenue. Greece’s Prime Minister George Papandreou said he’s going to put to a referendum the proposed plans for the bailout of the nation by other member of the European Union. A negative vote on the referendum may lead to a default. China’s Purchasing Managers’ Index fell to 50.4 in October from 51.2 in September, signaling about the slowdown […]

Read more November 1

November 12011

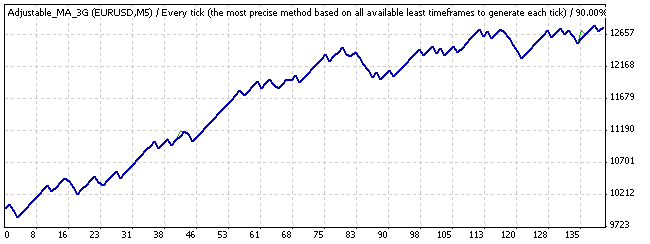

New Moving Average Expert Advisor — with 3rd Generation MA!

After coding down the 3rd Generation Moving Average indicator it was a very logical step to create an expert advisor from it. Since I’ve already had the Adjustable MA EA, which offers a lot of customization of trading parameters, I’ve decided to use it as the base for the similar EA but based on the new advanced MA indicator. Adjustable MA 3G is one step forward in moving average cross trading. […]

Read more November 1

November 12011

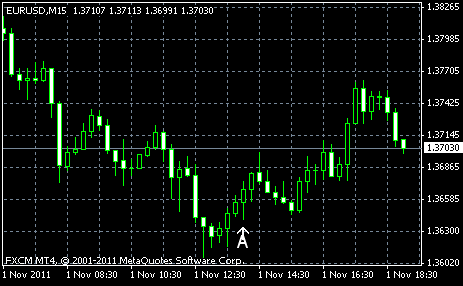

EUR/USD Down, Awaiting Greek Referendum

EUR/USD extended its decline for the third straight session today as Greek Prime Minister George Papandreou said he’s going to put the European Union bailout plans for Greece to a referendum. A negative vote may lead to a default of the nation. The reports from the US yesterday and today signaled that the economic growth is slowing. The Federal Reserve will hold a monetary policy meeting tomorrow. The main interest rate is expected to stay at the present […]

Read more November 1

November 12011

Euro Continues Decline as EU Economy Worsens

The euro extended its decline today as the fundamental data suggested the economy of the European Union worsened, spurring the speculation that the problems of the EU are too big to be resolved in the near future. The retail sales in Germany, one of the major European economies, rose 0.4 percent in September (seasonally adjusted), as Destatis reported, following the drop by 2.7 percent in August. That wasn’t a bad result, but economists hoped for a 1.1 percent increase. The unemployment […]

Read more November 1

November 12011

Traders Feel Doubts About EU Rescue Plans, CAD Suffers

The Canadian dollar weakened today after stocks declined as traders speculated that the European leaders would experience problems on their way to drag the European Union out of crisis. The optimism about the European rescue plan was really short-lived and investors weren’t very impressed by the agreements achieved by the EU politicians. The situation in Europe still has heavy impact on the global economy and currently it’s unfriendly for most assets, save for “refuge” ones. The Standard […]

Read more