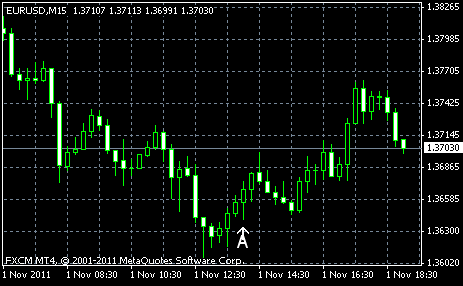

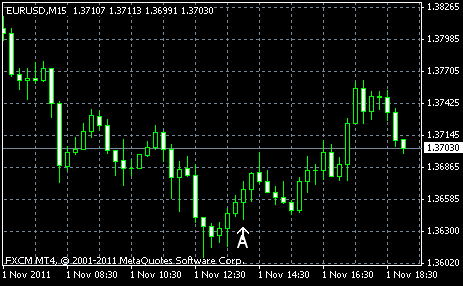

EUR/USD extended its decline for the third straight session today as Greek Prime Minister George Papandreou said he’s going to put the European Union bailout plans for Greece to a referendum. A negative vote may lead to a default of the nation. The reports from the US yesterday and today signaled that the economic growth is slowing. The Federal Reserve will hold a monetary policy meeting tomorrow. The main interest rate is expected to stay at the present record low level (near zero).

ISM manufacturing PMI decrease to 50.8% in October from 51.6% in the preceding month. That’s an unpleasant development as market participants hoped for an increase to 52.1%. The index is getting dangerously close to the 50.0% level that indicates absence of growth. (Event A on the chart.)

Construction spending rose 0.2% in September from August, following the 1.6% growth in the month before. The median forecast was 0.4%. (Event A on the chart.)

Yesterday, a report on Chicago PMI was released, showing a decline to 58.4 in October from 60.4 in September. A drop was expected, but only to 59.2. A value above 50.0 indicates expansion of business activity, but lower indicator means slowing growth. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.