EUR/USD rallied today even though concerns about the planned referendum in Greece regarding the austerity measures required to get bailout rule the Forex market. The euro reversed its upward movement for a short time, but currently it resumed its rally. The Federal Reserve helped the currency pair buy keeping the interest rates low and reiterating its pledge to hold the rates for a long time. The employment report from ADP showed the improvement of the US labor market and the previous reading was revised upwardly, but the growth of employment wasn’t much bigger and the

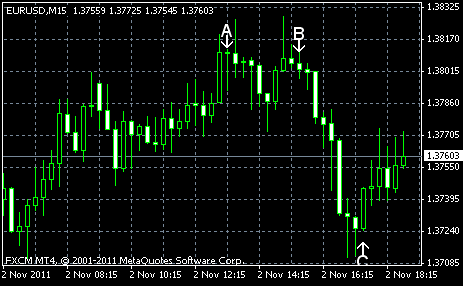

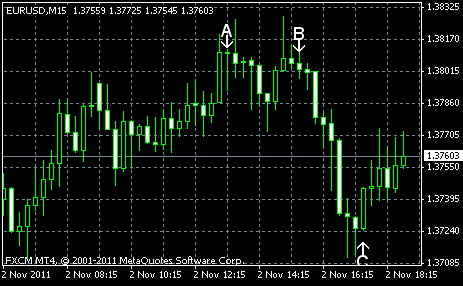

ADP employment report showed an increase by 110k jobs in October from September, following the advance by 116k in September (revised from 91k). Forecasts promised a decrease to 102k. (Event A on the chart.)

Crude oil inventories increased by 1.8 million barrels and total motor gasoline inventories increased by 1.4 million barrels last week from the week before. (Event B on the chart.)

FOMC decided to keep the federal funds rate at zero to 0.25%, as was expected by market participants. FOMC mentioned the persisting problems with the labor market and said:

The Committee continues to expect a moderate pace of economic growth over coming quarters and consequently anticipates that the unemployment rate will decline only gradually.

FOMC also reiterated its intension to keep the interest rate at the record low level through at least mid-2013. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.