- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: November 3, 2011

November 3

November 32011

No Referendum in Greece, Traders Less Concerned

The Canadian dollar rallied today as traders’ sentiment improved and risk appetite after Greek Prime Minister George Papandreou canceled the planned referendum about the austerity measures required to get the bailout. Europe and its financial instability continue to rule the Forex market, but today FX traders have felt some relief. The referendum in Greece, offered by the Prime Minister, was a grave threat to the Eurozone as it could easily lead to expelling of Greece […]

Read more November 3

November 32011

Rand Jumps After ECB Cut Rates

The South African rand climbed today after the European Central Bank made an unexpected move by reducing its main interest rate. The first monetary policy meeting of the European Central Bank under leadership of the new President Mario_Draghi provided a surprise as the key minimum bid rate was reduced by 25 basis points to 1.25 percent. The rand reacted positively to the news as lower interest rates reduces pressure on the frail economy of the European Union […]

Read more November 3

November 32011

UK Pound Gains as ECB Cuts Rates Unexpectedly

In a surprise move today, the ECB announced a rate cut of 25 basis points. The cut to 1.25 percent, the first move by new ECB president Mario Draghi, surprised nearly everyone. The move has given the UK pound some strength against the euro, and provided the pound with some strength against other currencies as well. As expected, the Bank of England is holding its own rate steady at 0.5 percent. Additionally, the BOE is […]

Read more November 3

November 32011

Euro Heading Higher, Even with Greece on the Brink of Collapse

The Greek government is on the edge of complete collapse. A bailout payment from the EU and the IMF ($8 billion euro due this month) has yet to be made, since there is uncertainty about whether or not Greece will meet the terms of the help. On top of that, Greek leaders are contemplating withdrawal from the eurozone. Rather than sinking the euro, though, this development is allowing the euro to strengthen a little bit. While the initial […]

Read more November 3

November 32011

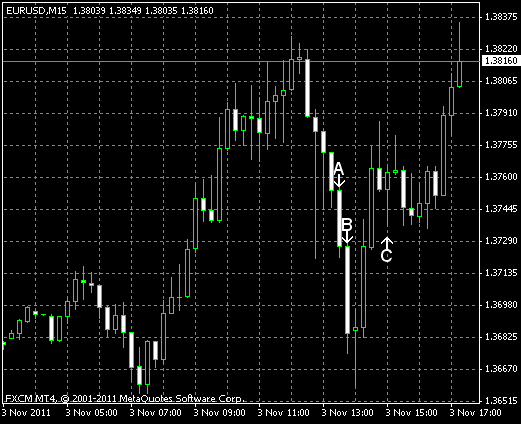

EUR/USD Goes Up as ECB Reduced Rates & Greek Referendum Won’t Occur

EUR/USD advanced today after the European Central Bank surprised markets, reducing its main interest rate (event B on the chart), and Greek Prime Minister George Papandreou canceled the planned referendum. The European Union leaders threatened to throw Greece out of the Union in case the country would reject the bailout. The lower interest rates are expected to reduce pressure on the EU economy that is unable to sustain higher borrowing costs. The US […]

Read more November 3

November 32011

Won Falls as Traders Look at Greek Referendum with Concerns

The South Korean won dropped today as the tension about the upcoming referendum in Greece continued to damp demand for riskier currencies of emerging markets. The European leaders said that Greece won’t receive any help until the referendum will be conducted. The negative outcome of the referendum may cause the country to leave the European Union. Mario Draghi, who succeeded Jean-Claude Trichet, will lead today his first monetary policy meeting as the President […]

Read more November 3

November 32011

USD Higher vs. Euro, Erases Losses

The US dollar regained its strength against the euro today after yesterday the US currency declined following the decision of the Federal Reserve to maintain the interest rates at the record low level. The Federal Open Market Committee maintained the key federal funds rate at zero to 0.25 percent and confirmed its pledge to keep the rates at the record low levels till at least mid-2013. The FOMC mentioned several problems of the nation’s economy, particularly the employment: Recent […]

Read more