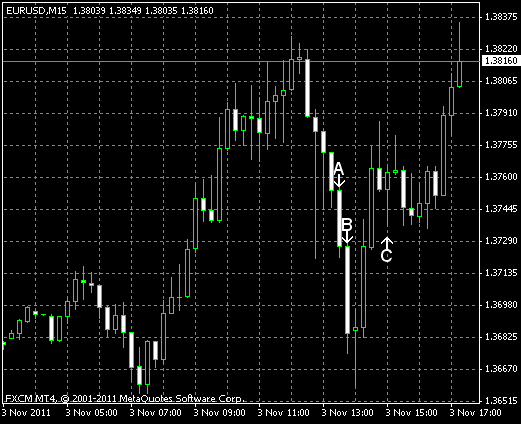

EUR/USD advanced today after the European Central Bank surprised markets, reducing its main interest rate (event B on the chart), and Greek Prime Minister George Papandreou canceled the planned referendum. The European Union leaders threatened to throw Greece out of the Union in case the country would reject the bailout. The lower interest rates are expected to reduce pressure on the EU economy that is unable to sustain higher borrowing costs. The US data today wasn’t very positive, but it can’t be called particularly negative, either.

Initial jobless claims showed a small change to 397k from 406k last week. The report was in line with forecast that predicted a small decrease to 401k. (Event A on the chart.)

Nonfarm productivity (preliminary) increased at the 3.1% annual rate during the third quarter, compared to -0.1% decline (revised from -0.3%) in the second quarter. The median forecast was 2.6%. (Event A on the chart.)

ISM services PMI followed the manufacturing PMI in decline, falling to 52.9% in October from 53.0% in the previous month. The decline was small, but forecaster promised an increase to 53.7%. (Event C on the chart.)

Factory orders rose 0.3% in September, following the 0.1% increase in August, while forecasts promised no change. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.