- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: November 10, 2011

November 10

November 102011

Japanese Yen Lower as Risk Appetite Makes an Appearance

The Japanese yen, after heading higher yesterday on risk aversion, is pulling back against major counterparts as a bit of risk appetite shows in Forex trading. Yesterday, Japanese yen surged on safe haven demand as eurozone troubles continued to mount. Today, though, with the ECB buying up Italian bonds in an effort to prevent disaster, and somewhat encouraging economic data coming from the US, risk appetite is making an appearance. As a result, […]

Read more November 10

November 102011

Aussie Downtrend Stops on Better Data

Concerns about the Australian employment report prompted the Down Under currency to lose ground to the US dollar and the Japanese yen yesterday. Today, though, the downtrend has stopped, and Aussie is gaining some ground. The employment report came in better than expected, with the jobless rate falling to 5.2 percent, rather than remaining steady at 5.3 percent. Many analysts expected October to be weaker than it was, and many Forex […]

Read more November 10

November 102011

Indonesian Rupiah Falls as Central Bank Cuts Interest Rates

The Indonesian rupiah slipped today after the Bank Indonesia decreased its main interest rate, while concerns about the European debt added to the downside pressure. The Indonesian central bank cut the key rate by 50 basis points to 6 percent today. It was a surprise move that caught traders unprepared as analysts predicted that the cut would by 25 points at most. The costs of Italy’s debt surged to the levels that forced […]

Read more November 10

November 102011

SNB Resists Urge to Weaken Franc Further

The Swiss franc strengthened today on the speculation the Swiss National Bank will refrain from raising the ceiling for the currency in the near future. The SNB may be unwilling to further weaken the franc because an increase of the cap for the currency is virtually the only instrument it has left in case the threat of deflation would materialize. The case for weakening the nation’s currency is strong, however, amid the mounting signs of slower growth and the central bank may be […]

Read more November 10

November 102011

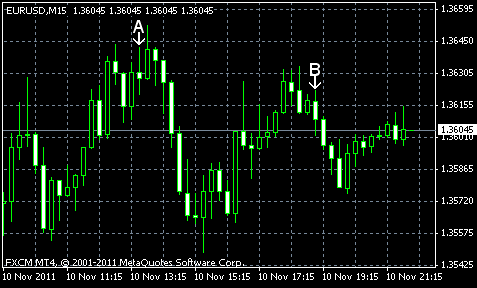

EUR/USD Climbs, Fundamentals Still Point to Downside

EUR/USD rose today after Standard & Poor’s confirmed France’s top AAA credit rating, following the message about a downgrade of the rating that was sent because of a technical error. Fundamentals remained negative for the euro, though. Yield on French 10-year bonds surged, adding to concerns about the European crisis. The data from the US was more beneficial to the dollar than to the euro as the reports were better than forecasts for the most part. […]

Read more November 10

November 102011

Euro’s Biggest Drop Since August 2010

The euro posted the biggest drop since August 2010 yesterday, reaching the lowest level this month against the dollar and the yen and the lowest price since February against the pound today, as Forex market participants are becoming more and more concerned about the European debt crisis. The yield in Italy’s 10-year bonds soared to 7.48 percent yesterday. Traders are worried that Italy, like Greece, may struggle to elect a new leader, […]

Read more